Current Opportunities in Public Credit Markets

Key Takeaways

- Credit has an evergreen appeal, and current conditions make this an attractive time to invest.

- Systematic active credit strategies are relatively new and offer a compelling way of allocating to the asset class. These strategies offer advantages over ostensibly passive vehicles, and they complement traditional discretionary approaches.

- Systematic security selection applies concepts similar to those used in the equity world, but differences between the two markets call for specialized skillsets and infrastructure.

Table of contents

In the U.S., outstanding public corporate debt has more than tripled from before the Global Financial Crisis to $9 trillion, roughly one-fifth the size of the U.S. equity market.1 The range of participants has also expanded, not just through broadened issuance but also through developments like the expansion of direct lending and bank loans. The rapid growth of electronic trading and increased availability of data have improved market liquidity and transparency.

The corporate credit market’s evolution has brought new attention to this distinct asset class along with new opportunity for investors. In this note, we make a case that, beyond the evergreen appeal of exposure to the credit risk premium, corporate credit allocations look attractive in the current market and economic environment. We discuss advantages of systematic active credit strategies as a method of allocation and demonstrate their complementarity to traditional discretionary credit portfolios. We also touch on key similarities and differences relative to systematic equity, which highlight the need for specialized skillsets and infrastructure.

Corporate Credit Allocations: Current Appeal

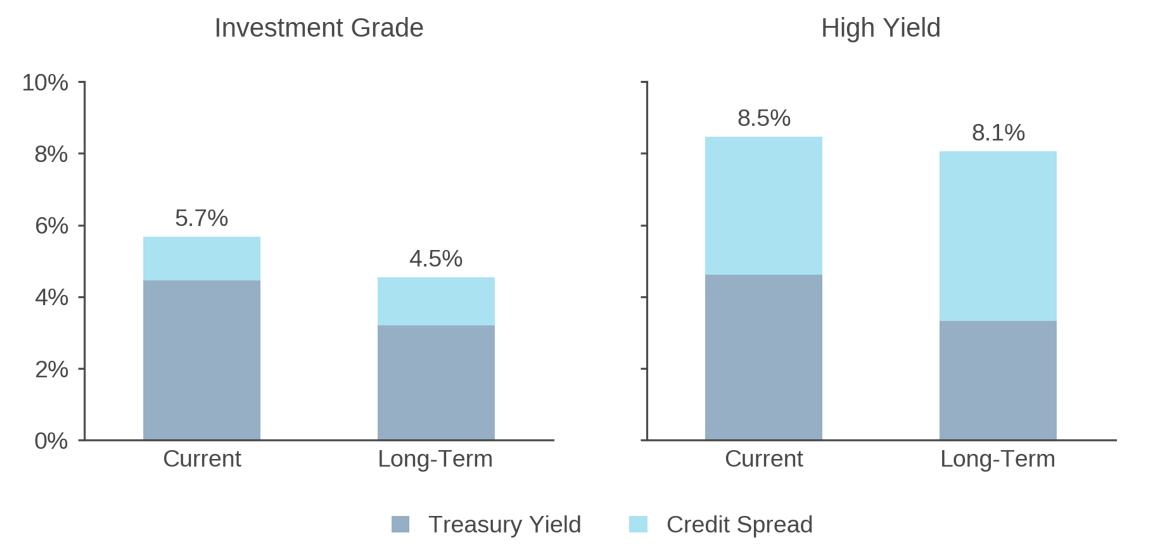

In the current environment, investment grade and high-yield markets offer attractive compensation for bearing credit risk. The spread above Treasuries in investment grade is in line with the long-term median (122bps versus 134bps). In high yield, spreads are close to 400bps but have tightened year-to-date to below the long-term median of 473bps. As Figure 1 shows, adding this credit spread onto risk-free Treasuries results in all-in yields of 5.7% in investment grade and 8.5% in high yield, both of which are above the long-term median and high enough to meaningfully help many asset owners meet performance targets.

Figure 1: U.S. Corporate Credit: Current Yields in Long-Term Context

Yield to Worst

We view current spreads as especially favorable given the strength of corporate balance sheets. Interest coverage ratios for both universes are at or above multi-decade highs, and the net-debt-to-EBITDA ratio for the median high-yield-rated company is at a 10-year low.2 These conditions are a byproduct of the low interest rate environment from late 2020 to early 2022, which incentivized companies to issue debt and lock in favorable financing costs. In contrast, floating rate debt in the private credit and bank loan markets have led to higher interest expenses, which could increase the number of defaults and restructurings.

Exposure to the Credit Risk Premium: An Evergreen Case

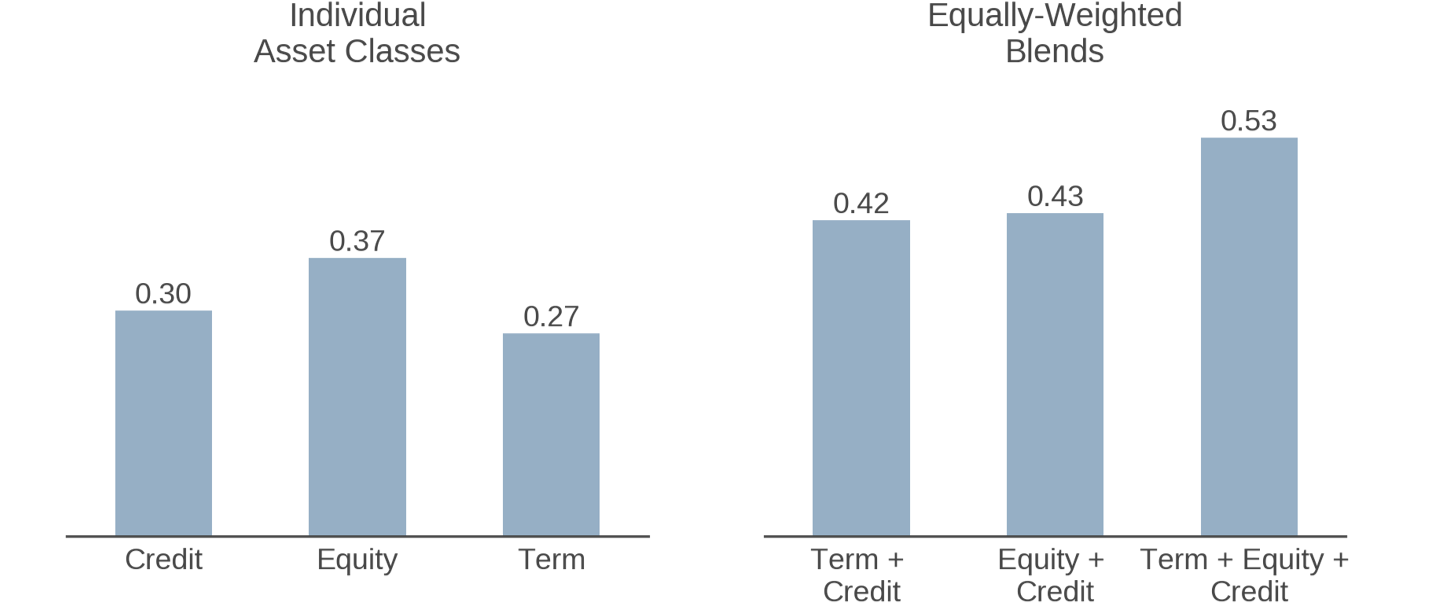

The credit risk premium, which provides compensation for bearing the risk of degrading credit worthiness and default, is observable across geographies, rating categories, industries, and maturities, in both cash and derivative markets.3 In the U.S., investment grade (IG) and high yield (HY) credit excess returns over Treasuries have averaged 0.8% and 2.7%, respectively, during the past 25 years.4 The left panel of Figure 2 shows that risk-adjusted returns (i.e., Sharpe Ratios) from IG credit look reasonably comparable to those generated by equities and intermediate Treasuries over the past 50 years.

The credit premium is distinct from both the equity premium and the term premium. Intuitively this makes sense, because they arise from different economic drivers (and are priced in different markets). The term premium reflects risk that interest rates may change, and it has a de minimis correlation with both credit and equity. Credit and equity premia derive from different aspects of and sensitivities to company fundamentals,5 and their returns have only a modest correlation with one another (0.36).

The diversification benefit from adding a credit allocation that these low correlations imply is shown directly in the right panel of Figure 2. Adding an equally weighted credit allocation to equities or bonds generates substantial increases in Sharpe Ratios, and an equally weighted portfolio of all three performs even better.

While the analysis in Figure 2 is based on IG credit, which offers the longest available history of data, HY has also offered strong returns and diversification benefits relative to equities, although more modest than IG. Since 1989, HY has realized a Sharpe Ratio of 0.29 and an equity correlation of 0.59 (versus 0.44 for equities and IG over this more limited period).

Figure 2: Long-Term Sharpe Ratios

New Opportunity: Systematic Active Credit

Systematic active credit strategies represent a relatively new and attractive method of investing in corporate bonds, either on a standalone basis or as a natural complement to traditional discretionary credit allocations.

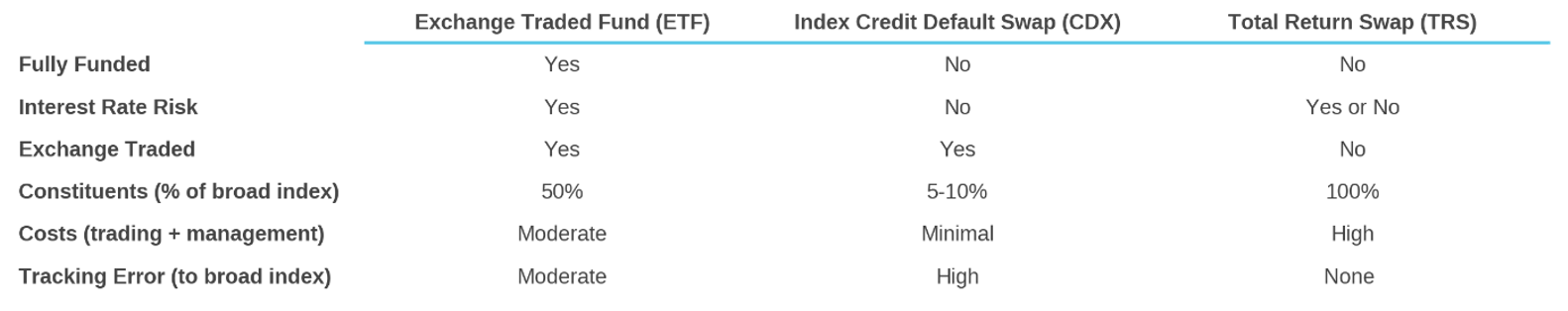

The institutional credit market is overwhelmingly an active, rather than a passive, space. Though a variety of passive credit vehicles exists, they all fall short in one way or another of replicating a broad corporate bond index (see Figure 3). As a result, even asset owners who primarily seek to access the credit risk premium rather than incremental returns from security selection, generally do so via expressly active strategies.6

Figure 3: Characteristics of Passive Approaches in the U.S. Credit Market

Within this active sphere, discretionary strategies still dominate. Application of systematic investing concepts to corporate bonds wasn’t even formally studied until the early 2010s. Their late adoption is attributable to a lack of publicly available data for corporate bond transactions, complexities in modeling finite-life securities with different terms and seniority, and a historically manual trading environment. But times have changed. The market is awash in data, infrastructure to support its analysis is more accessible than ever, and electronic execution is now commonplace. As a result, systematic active management is now feasible and growing.

In systematic credit, broad themes motivating security selection tend to resemble those that drive systematic equity, i.e., capturing mispricings that derive from behavioral biases, informational inefficiencies, market-structure effects, and dislocations. Signals tend to differ, however, because many attributes and events that predict stock returns have little efficacy in credit or even produce contrary effects. For example, stock buybacks and special dividends are typically good news for equity holders but bad news for creditors because, all things equal, they leave less cash on-hand to pay existing debt. As such, successful systematic credit investing requires specialized skillsets and different infrastructure than systematic equity.

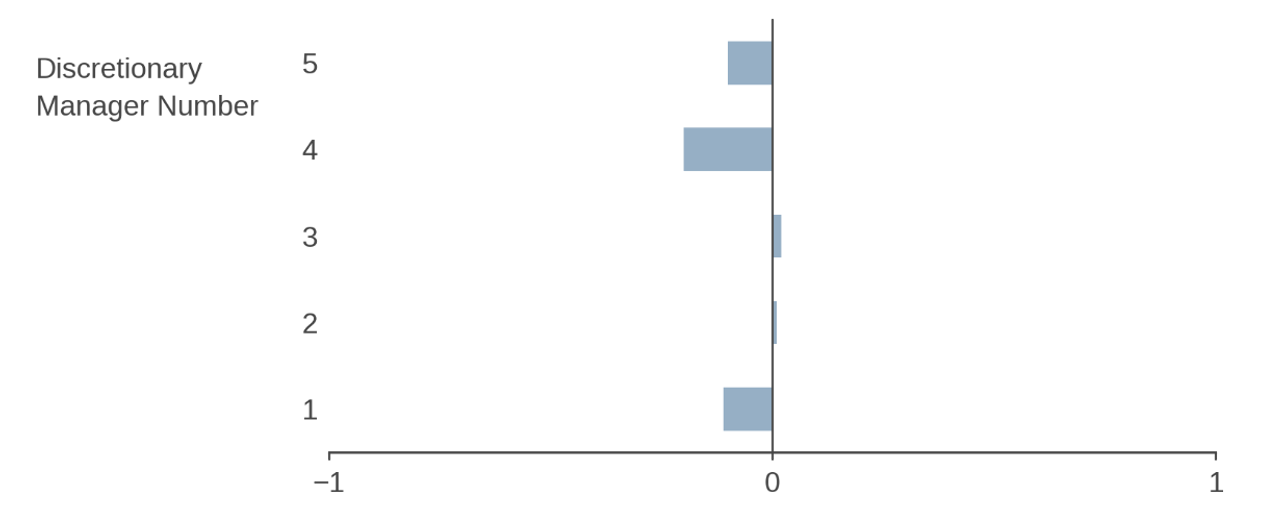

Systematic credit is also demonstrably additive to discretionary credit allocations. Figure 4 shows that the aggregate holdings of large discretionary managers score poorly with respect to attributes that systematic managers tend to seek, with flat to negative exposures to a composite of value, momentum, carry, and quality characteristics. Much as in equities, top discretionary credit portfolios, which are also larger in AUM than available systematic offerings, are likely selecting bonds based on different criteria, e.g., taking sector or ratings bets or market timing. Even in cases where the investment approaches of discretionary credit managers are philosophically aligned with systematic concepts, e.g., seeking bonds with attractive spreads from high-quality issuers, they likely employ different metrics of relevant characteristics, including measures of default risk. For these reasons, systematic and discretionary allocations can sit naturally with one another in a portfolio.

Figure 4: Top Discretionary Managers’ Exposures to a Systematic Credit Approach

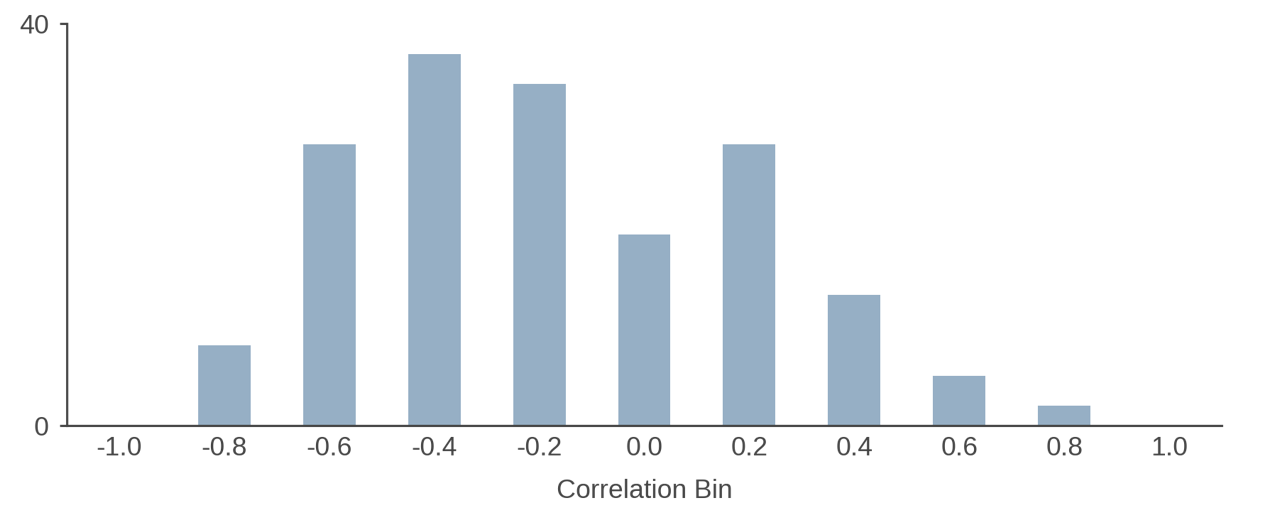

Moreover, advantages of systematic risk modeling, portfolio construction, and implementation are also evident in the data. Figure 5 shows that (largely discretionary) high-yield strategies deliver imprecise and, on average, low credit exposure relative to their benchmarks. This under-realization of beta is likely a function of higher cash reserves, overly conservative bond selection (e.g., avoiding headline risk of holding defaulted bonds), and an aversion to topping-up risk via derivatives. Regardless of the motivation, the systematic investing framework is designed to help managers monitor key exposures and target them with precision.

Figure 5: Correlation of Excess Returns versus High Yield Credit Risk Premium

Conclusion

There is an evergreen case for corporate credit allocations, but in the current environment we find them particularly appealing because 1) all-in yields have returned to levels that meaningfully help investors reach overall performance targets, and 2) current credit spreads offer attractive compensation for risk. In implementing credit allocations, we would encourage investors to explore systematic active strategies. Now feasible and growing, systematic active credit offers numerous advantages relative to ostensibly passive vehicles and is additive relative to traditional discretionary credit offerings.