Quick Take: Fortune Favors the… Boring?

Celebrities and Super Bowl ads glamorize crypto trading—at any risk

-

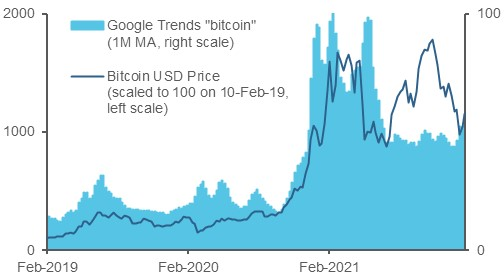

Bitcoin more than quintupled in 2020 and doubled again through early November of 2021 before retreating. The impressive returns attracted broad popular attention (top chart). They also caught the eye of multi-asset allocators, despite signs of rampant speculation.

-

We see the temptation of lottery-like payouts on cryptocurrencies as a major source of their appeal. To the extent that well-established coins enter the investment mainstream and behave more regularly, we expect new coins to attract risk-seekers hoping for explosive gains.

-

This affinity for risk is not new: in equities, it has driven the overpayment for high-beta stocks for decades.

Traders overpay for crypto risk, much as they do in other asset classes

-

To assess the pricing of risk in crypto markets, we conducted a simple experiment. From the most popular coins with available prices from January 2021 – February 10, 2022, we estimated a daily risk model and constructed the resulting minimum variance cryptocurrency portfolio. The portfolio exhibits a beta of roughly 0.875 relative to a cap-weighted coin basket.

-

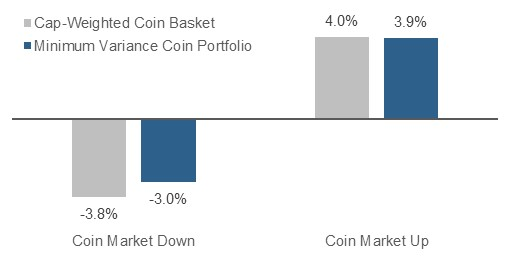

This minimum variance portfolio outperforms in much the same way that low volatility portfolios do in other asset classes: over the sample period, it exhibited statistically significant alpha relative to the cap-weighted basket, despite the massive crypto run-up, and larger upside than downside participation (bottom chart).

-

Despite the short data history, these results suggest that crypto is yet another asset class in which risk is mispriced, a behavioral phenomenon that we observe within nearly all financial asset classes.

Surging Bitcoin Prices Attracted Search Engine Interest

Hypothetical Crypto Minimum Variance Portfolio Upside/Downside Capture