Reflections on a Generation of Investing in EM Equities

Key Takeaways

- 2024 marks the 30th anniversary of CCAT’s core emerging markets (EM) strategy. Experience accrued over the past three decades informs our present investing approach.

- The past few years have reinforced the value of systematic investing in EM. Well-diversified, fundamentally driven strategies have outperformed as speculative sentiment abated.

- The opportunity set for systematic investing in EM is now broader than ever, owing to expansion of the investible universe, improved data coverage, and a secular downtrend in trading costs.

Table of contents

Thirty years ago, in 1994, CCAT pioneered the application of systematic, active investing to emerging markets, adapting concepts from behavioral finance to exploit inefficiencies in what was still an exotic asset class.1 Since then, the landscape of emerging market (EM) investing has changed dramatically, and our approach to investing there has evolved accordingly. In this brief note, we highlight key aspects of what has changed, what has not, and why we’re excited about the prospects for systematic investing in EM over the next 30 years!

Data Revolution and Investing Evolution

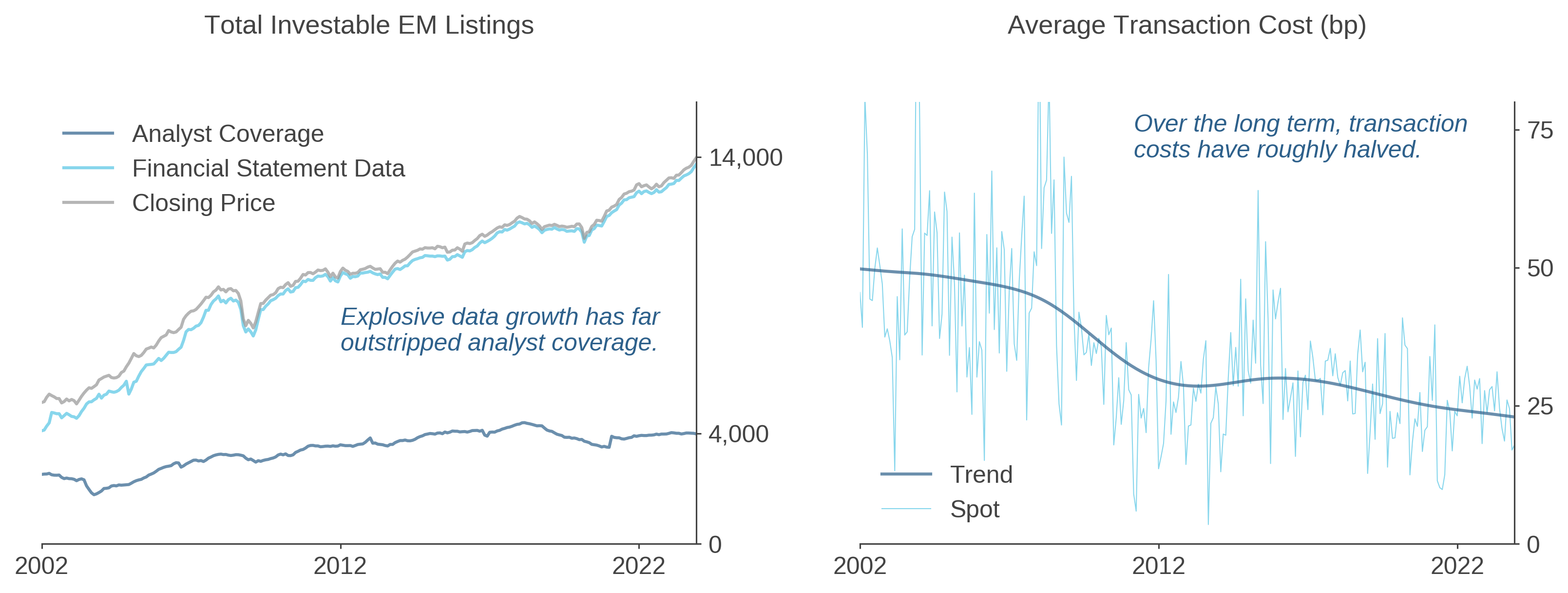

The landscape of active, systematic investing in EM has transformed over the last 30 years. Back in 1994, when CCAT launched its core EM equities strategy, we dealt with nascent markets and lagged data. Much has changed. With respect to data, company-level fundamentals and market information were sparse and not necessarily available digitally. We often pulled data manually from hardcopy publications (e.g., from S&P and the IFC). Since then, we have seen extensive growth in both standardized datasets from high-quality vendors as well as unstructured data. This has allowed for the expanded application of proprietary signals across high-breadth emerging markets like India, Taiwan, China, and Korea. Despite the improvements in data availability, however, analyst coverage still lags in EM (Figure 1, left). This has created a rich source of behavioral inefficiencies that systematic investors are equipped to exploit. Retail investor-dominated markets, such as India and onshore China, are especially intriguing in this regard.

Figure 1: Long-Term Trends in Data Availability and Trading Costs

In addition to the information environment, emerging equity markets themselves have also evolved. As we’ve discussed in prior research, in the early 1990s, Latin America at times accounted for 50% or more of the benchmark. Today, Asia dominates, with more than a 70% weighting in China, India, Taiwan, and South Korea.2

Accessibility and trading infrastructures have improved, resulting in increased global institutional participation, impressive gains in trading efficiency, and a downtrend in aggregate transaction costs (Figure 1, right). In the early days, many major markets, such as India, required physical settlement. CCAT PMs recall anecdotes about couriers speeding through the jammed streets of Mumbai with stock certificates precariously tied to milk crates. Fast forward to present day: the same country is poised to become the first market in the world to target instantaneous electronic settlement.3 In this respect, some EMs have truly emerged.

The nature of the opportunity set is also dramatically different. Monikers like “resource play” no longer fit EM equities as they once did. In the early days, materials accounted for about 20% of the MSCI EM Index. In contrast, information technology’s exposure stood at a mere 1.5% (!), and that was entirely attributable to hardware stocks. There were no software or semiconductor stocks in the benchmark. Today, in stark contrast, almost 70% of global semiconductor needs are met by Taiwan, South Korea, and China. IT now accounts for 20-30% of prevalent cap-weighted EM benchmarks.

Risk: The More Things Change…

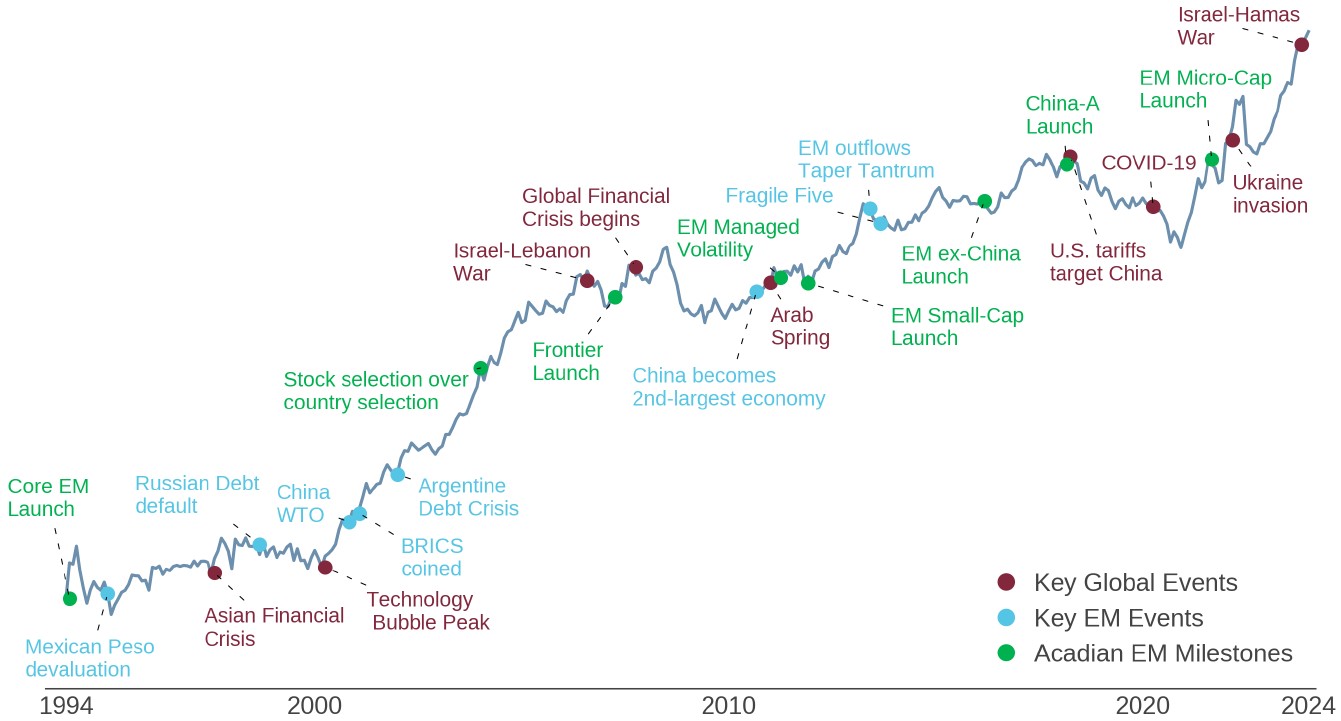

Geopolitical risk has been at the forefront of EM investors’ concerns in recent years. That’s only natural given China/ Taiwan tensions, anxiety about the Korean peninsula, and Russia’s invasion of Ukraine. But geopolitical risk has always been an inherent feature of EM investing. The launch of our core EM equity strategy, for example, was immediately followed by a series of EM-centric crises that shook markets worldwide: the Mexican peso devaluation in 1995, the Asian financial crisis in 1997, and Russia’s debt default in 1998 (Figure 2). Such events prompted innovation. One early adaptation was a proprietary risk measure in our country model aimed at detecting abnormal patterns in currency and equity market volatility. This feature helped us to tilt away from the Argentine debt crisis in 2001.

Figure 2: CCAT EM Composite Cumulative Active Return since Inception

In addition to developments aimed at managing geopolitical risk, research and process refinement has also focused on disambiguating it from opportunity. As an example, in the early 2000s we observed that some markets looked persistently cheap. We hypothesized that local corruption could be impeding profits, and hence returns, from accruing to shareholders. As a result, we incorporated measures of corruption risk into our country models to better detect these “value traps,” i.e., countries that stayed cheap by standard valuation measures. Although much has changed, our philosophy has continued to rely on the well-established foundations of behavioral finance to better isolate and exploit inefficiencies created by investor over- and underreaction in markets.

The Outlook for Systematic EM Investing

As we look ahead, we are excited about prospects for systematic EM investing. In view of the current landscape, we would offer allocators a few words of wisdom:

First, embrace sophistication in EM investing. In the early days, stock selection methods that leaned on rudimentary indicators like unadjusted price-to-book ratios and academic formulations of price momentum could generate excess returns. But many such signals have become commoditized or distorted in interpretation, even in EM, and their performance has deteriorated. Improvements in EM data and trading environments, which we expect to continue, allow for—and increasingly necessitate—the application of nuanced signals, much like those applied in developed markets (although often with EM- or even market-specific variations in formulation). We believe that systematic approaches that exploit novel data and analytical methods and adapt to the ongoing evolution of emerging financial markets will continue to reward investors.

Second, embrace what is distinct in emerging markets. In the 1990s, EM benchmark indexes produced return streams that helped to diversify DM allocations. But decades of global economic and financial market integration have dramatically changed the picture. Passive EM allocations are dominated by large-cap stocks that are well integrated with the global economy. As a result, returns of cap-weighted EM indexes now can be largely explained by global risk factors. For active EM investors, however, the full investible universe offers a distinctive opportunity set, with a large pool of companies whose returns are driven by local influences.4 To reap the benefits, we would encourage EM investors to take material active risk relative to top-heavy cap-weighted indexes.

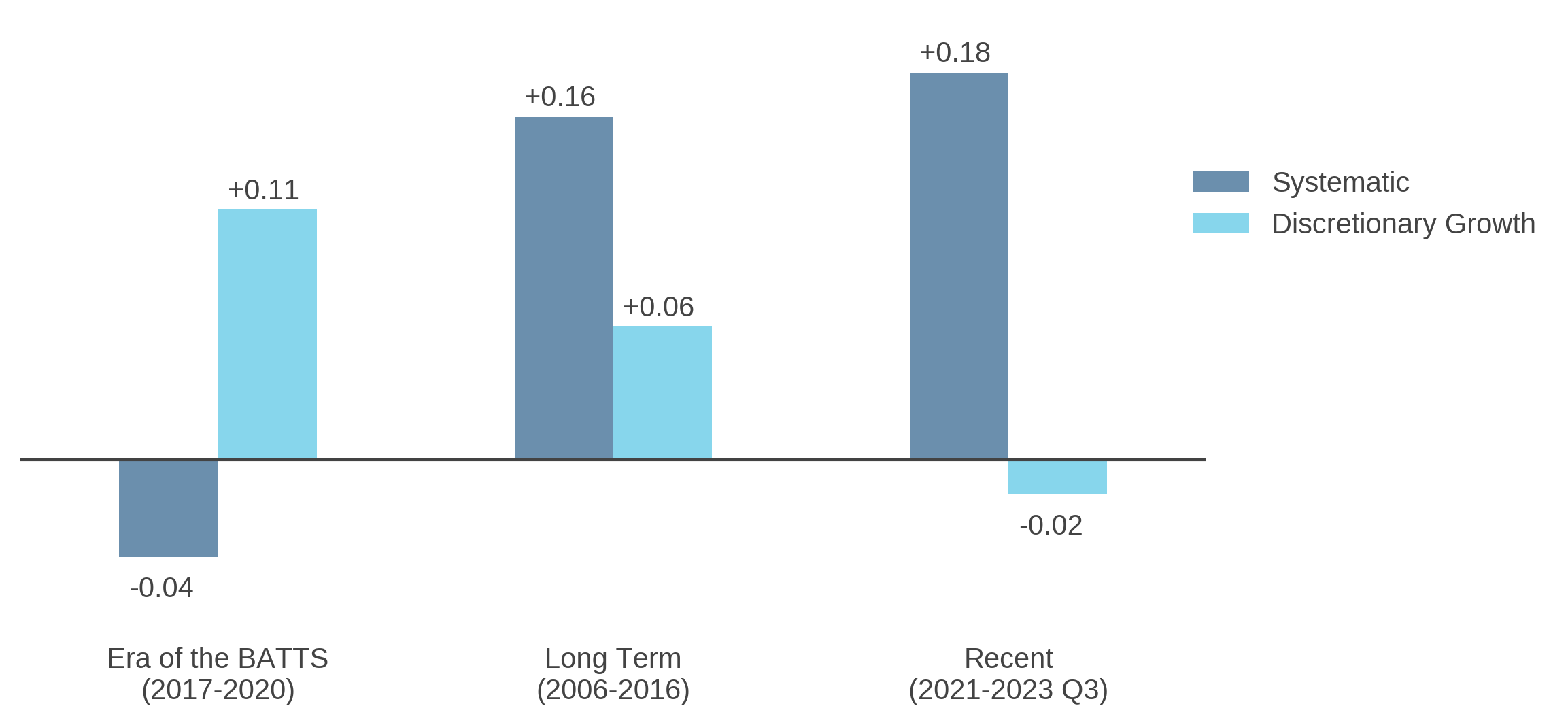

Finally, re-commit to well-diversified EM investments. Over the years, we have seen our fair share of narrow fads come and go. Remember the BRICS or their evil twin, the “Fragile Five?” The BATTS provide an especially pertinent example. This handful of mega-cap technology stocks became the darlings of many EM managers from 2017-20.5 For a time, this positioning paid off as the BATTS delivered approximately +30% returns per annum.6 Figure 3 shows that over these years, growth-focused discretionary EM managers outperformed even the cap-weighted benchmark, which benefited greatly from the BATTS’ runup. But, in late 2020, when Chinese regulators cracked down on offshore-listed platform companies, growth fervor collapsed. Since then, well-diversified, fundamentally driven strategies have resumed their historically characteristic outperformance.7

Figure 3: Median Manager Information Ratio

Conclusion

The embrace of change has been a hallmark of CCAT’s journey through emerging markets over the past 30 years. As we reflect on milestones passed and experience accrued, we are reminded of the appeal of a disciplined yet adaptive investment process. We look forward to many more years of leveraging this ethos to generate value for our EM investors.