Investing with Big Data

Table of contents

It seems hard to open an investment publication these days without finding an article about how “big data” is set to revolutionize the investment world. Is this the reality, or is it hype? In this note, we provide structure to the big data discussion, focusing on what types of big data might most benefit different investing styles. We highlight underappreciated challenges in the application of big data as well as assess the big data attributes that offer the greatest investment promise. This background should help asset owners who are assessing strategies and approaches that purport to benefit from big data.

Bringing Structure To Big Data

Big data has generated excitement in the investing world because of its potential to vastly expand the information set relative to the types and sources of data used in traditional investing approaches, both qualitative and quantitative. But the excitement also derives from the mystery—or perhaps better put, ambiguity—associated with big data. While the term “big data” has become a ubiquitous buzzword, it doesn’t have an agreed-upon definition. The concept is often vibrantly conveyed via examples, such as search engine traffic, social media feeds, satellite photos, or credit card transactions.

To better understand big data and evaluate its applicability, we can classify it in terms of two key attributes, breadth and speed. Breadth refers to the range of securities for which a particular type of data is both relevant and available. Speed refers to how quickly the data both updates and changes.

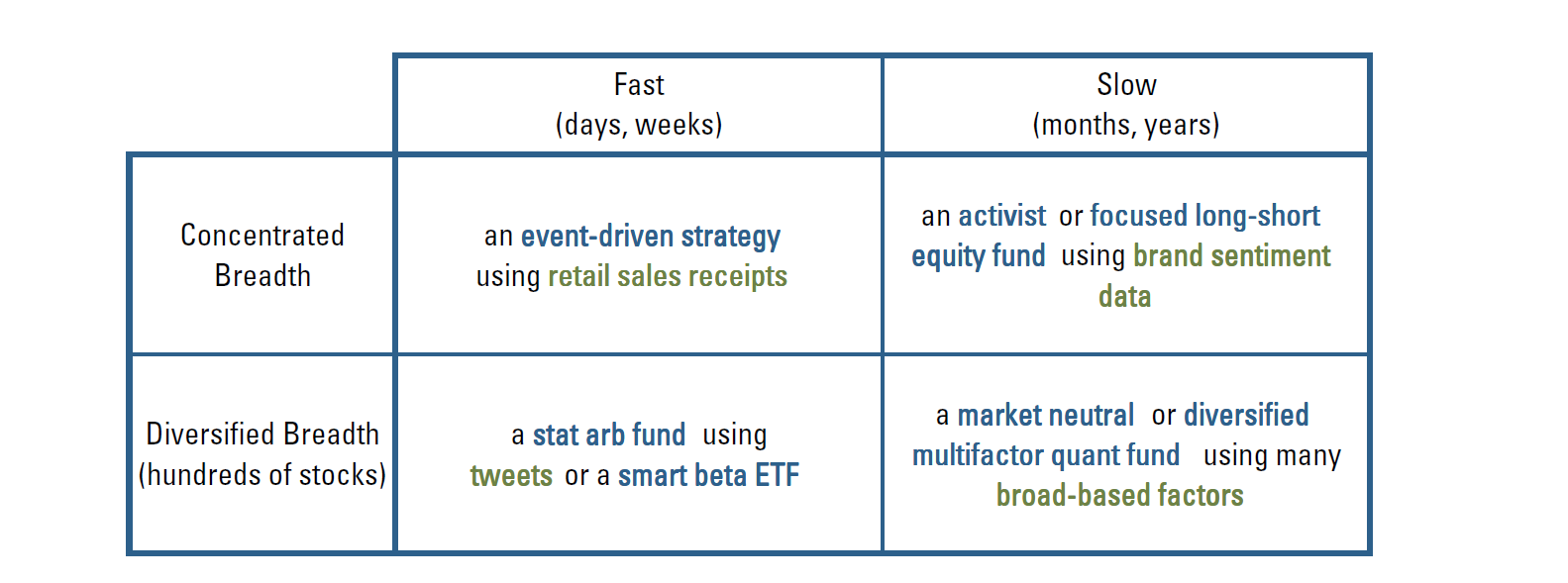

What are the salient distinctions between categories, and what types of big data are most relevant to different investment styles? (See Table 1)

Table 1: Types of big data and investment styles that might derive value from them

This breakdown offers four different intersections of breadth and speed:

1. Concentrated and Fast: Many oft-cited big data examples result from reasonably frequent monitoring of information associated with a specific firm, a particular product, or a narrow consumer group. As such, they have their most promising application in forecasting a specific company’s or industry’s near-term earnings and returns.1 Satellite imagery, for example, might help to gain early insight into production activity on a facility-by-facility basis. Parking lot data, credit card payment data, and search engine traffic all may provide information that is useful in assessing recent consumer activity associated with a particular company or product. Concentrated and fast data also might be useful in event-driven contexts. Media reports, for example, have suggested that flight patterns of corporate jets might help to predict M&A transactions (reminiscent of the movie, “Wall Street”).2

However, by nature, “Concentrated and Fast” big data isn’t uniformly available or aggregatable to broad segments of the investment universe. Credit card data, for example, may be far less relevant for materials and energy sectors than consumer sectors. Lack of breadth directly limits the relevance of this type of data, and raises its effective cost by limiting economies of scale in its application. Concentrated and Fast data might be of greatest value to sector-specific or other narrow managers and catalyst-driven investors, and it poses challenges for quantitative managers, who require breadth.

2. Concentrated and Slow: Slower moving concentrated big data may provide insight into longer-term trends. As an example, tracking trend growth in the utilization of a company’s parking lots over time might reveal opportunities for a takeover or turnaround. Persistent patterns in receipt data or internet search traffic might reveal gradual trends in consumer preferences and behaviors. Concentrated and Slow data might benefit activist investors, who tend to take focused, long-term positions, or concentrated long-short funds. Real-estate investors might find value in smart phone location data, which could indicate where people are spending time and suggest successful locations.

3. Broad and Fast: The broad and fast quadrant includes data sources that are of short term relevance and apply to a large proportion of the investment universe. A prominent example would be parsing news of social media feeds to derive sentiment indicators. Such data sources offer information on an enormous cross-section of companies, providing extraordinary breadth. The derived sentiment indicators tend to change quickly, making them particularly applicable to market making and relatively high frequency strategies (i.e., intraday holding periods). Such indicators tend to be less useful for fundamental investors who are focused on predicting earnings. In addition, over the horizons relevant to such investors, they may not provide much incremental information over and above signals derived from available market data, e.g., trading volume.

4. Broad and Slow: To be useful, data sources in this domain should ideally relate to something obscure or otherwise difficult to measure, yet that is relevant to the bulk of the investment universe to most firms. For example, big data that helps to precisely estimate complex or nebulous aspects of firm valuation, including intangibles, intellectual property, strategic relationships, and employee sentiment / firm hiring behaviors. Such information might inform quality signals that predict long-term earnings growth and stability based on management behavior. Broad and slow data might also be relevant to value investors trying to understand whether the market is mis-extrapolating broad consumer trends or technological changes. Broad and slow data is particularly applicable to multi-factor quantitative funds that derive stock forecasts based on a wide range of signals, require high breadth, and have holdings periods measured in weeks or a few months.

Challenges

The above discussion suggests how different types of big data may benefit different types of investors, but subtle yet important challenges confront managers in all big data applications.

Mapping data to tradable assets: Big data often doesn’t come naturally mapped to a particular company or group of firms, and the mapping process may be challenging. For example, while internet search data might provide early insight into consumer activity, processing the raw information involves tying search data to a specific company’s products, aggregating across multiple products to the company level, and matching company-level data to a security identifier (ticker or otherwise). And there are a variety of potential complications along the way. Parsing search strings or text may not be easy.3 Search engine providers may not tag queries by firm. For companies offering a variety of product lines, it may not be clear which one is most important in the effort to predict earnings. In practice, a significant fraction of available data may be discarded during the mapping stage. So, “big data” may shrink significantly before data analysis can even begin.

- Data quality: Big data is often a byproduct of another activity, e.g., target marketing, optimizing customer experiences, or scientific research, and it often does not have sufficient resolution or reliability to be useful for investing. For example, while the broad intuition behind using satellite data to predict company or economic activity sounds straightforward, the images captured from above may indicate activity—what does one do about cloud cover, other seasonal effects, or mechanical failures? What if the image resolution changes over time? Are data updates sufficiently timely? Is there surety that the data will be generated consistently going forward?

- Capacity: The prevalence of big data that is both concentrated and fast raises capacity concerns, because it suggests a potentially costly combination of substantial, frequently churned positions. In evaluating managers who tout benefits of big data, asset owners should inquire about both breadth and time horizon in the context of both implementation costs and risk management.

- Spurious results: As sources of big data continue to expand, we run the risk of data mining without understanding how our information fits in a rational underlying investment thesis. As more data sources are explored, so does the chance of finding relationships that are spurious. Selecting data projects based on a clear investment thesis and consistency with a manager’s investment style is one defense against counterproductive data mining; modern data science approaches can also help. But with technology making more and more data accessible, researchers should expect lower “hit rates” from empirical research and that some formerly proprietary data sources may no longer add value.

Likely Near-Term Benefits For Multifactor Quant

One of the most promising applications for big data is its potential to help managers better predict the fundamental drivers of stock returns. As illuminated by Campbell and Shiller (1991),4 stocks’ alpha should be strongly related to expected future dividends, which depend on earnings, as well as the rate at which the market discounts risky future cash flows. Many examples of big data could help forecast earnings growth, in that they provide insight into what goods consumers are purchasing, how busy a company’s stores or production facilities are, and other indicators of economic activity.

But such information is also captured by traditional data sources, such as financial statements, analyst earnings estimates, and economic releases. So the question becomes what incremental value is big data most likely to provide? Four possibilities include:

1. More informative data: Adding new sources and dimensions of information might generate unique predictive insights. But the bar is high. Quantitative investors, in particular, have long sought to exploit all available data in the development of additive signals. For quants, big data is not a distinctly new endeavor.

2. Faster data: Many traditional sources release information on established reporting cycles with considerable time lags. (E.g., earnings, government macroeconomic data.) Alternative data sources may provide similar insights that can be acted upon in advance of the formal releases.

3. Cleaner data: Big data could be less “noisy” than traditional sources, thereby providing a cleaner picture of fundamentals or economics. This advantage may be short-lived, however, as noise in traditional information sources tends to self-correct reasonably quickly.

4. Less-biased data: Another advantage of big-data sources is that they may be more free of management manipulation. Company manage-ment produces headline earnings numbers, and it has incentives to smooth earnings or otherwise influence investors. With big data, investors grow closer to having the same insight as the managers themselves.

Conclusion

Investing with big data has intriguing potential, but working successfully with these types of strategies requires good judgement. Not all big data is suited for all kinds of investing. A successful big data project will match the strategy’s investment style, especially in terms of speed and breadth. In addition, knowing the common challenges of big data ahead of time can help with prioritizing projects and choosing data-driven strategies with higher probabilities of success. Quantitative investment strategies offer some insight into how data can be linked to fundamental drivers of stock return. There is potential for big data to yield predictive company information more quickly and more accurately than traditional data sources. But big data is not a panacea or a silver bullet. Investors should carefully assess the type of data being used and its appropriateness for the goals of a given investment strategy.