Rising Tiger, Falling Dragon: Theme Du Jour in EM Equity Investing

Key Takeaways

- Rising Tiger, Falling Dragon,” i.e., long India, Short China, has become the latest emerging markets (EM) equity investing theme.

- Macro thematic investing in EM is risky and restrictive, however. Trades that come into vogue, like Rising Tiger, Falling Dragon, are often superficially based—reflective of past price trends—and vulnerable to sudden reversals of sentiment.

- We would encourage EM investors to resist latching on to this latest theme, and instead to stay invested in EM through diversified active strategies. To find opportunities, cast a wide net across the full EM universe, and employ an information set that extends well beyond just the macroeconomic picture.

Table of contents

While investors have been enthralled by the recent surge in Indian stocks, they have been disappointed by three years of struggles with Chinese equities. The divergent performance between these two countries’ stocks has birthed a theme that we call “Rising Tiger, Falling Dragon.” However, this is only the latest in a series of popular emerging markets (EM) themes, many of which have initially captivated but later frustrated investors. Past memes, such as the BATTS, offer valuable reminders of the risks inherent in chasing macro themes in EM and the shortcomings of their typical implementations. Instead, we would encourage EM investors to stay broadly invested, and to embrace active strategies that cast a wide net over the full investment universe and identify opportunities based on much richer information than just the macro picture.

EM Theme Du Jour

Rising Tiger, Falling Dragon has become the EM investing theme du jour. At a superficial level, the thesis makes sense, because the underlying sentiment that it captures is consistent with the macro picture. From an economic perspective, India and China appear to be at polar extremes. China, at one end of the spectrum, faces headwinds from the 3Ds – Debt, Demographics, and Deglobalization. The same factors seem poised to benefit India – no debt overhang that could inhibit economic growth, a growing working age population, and an emerging destination for global corporates seeking to diversify their supply chains (reglobalization).

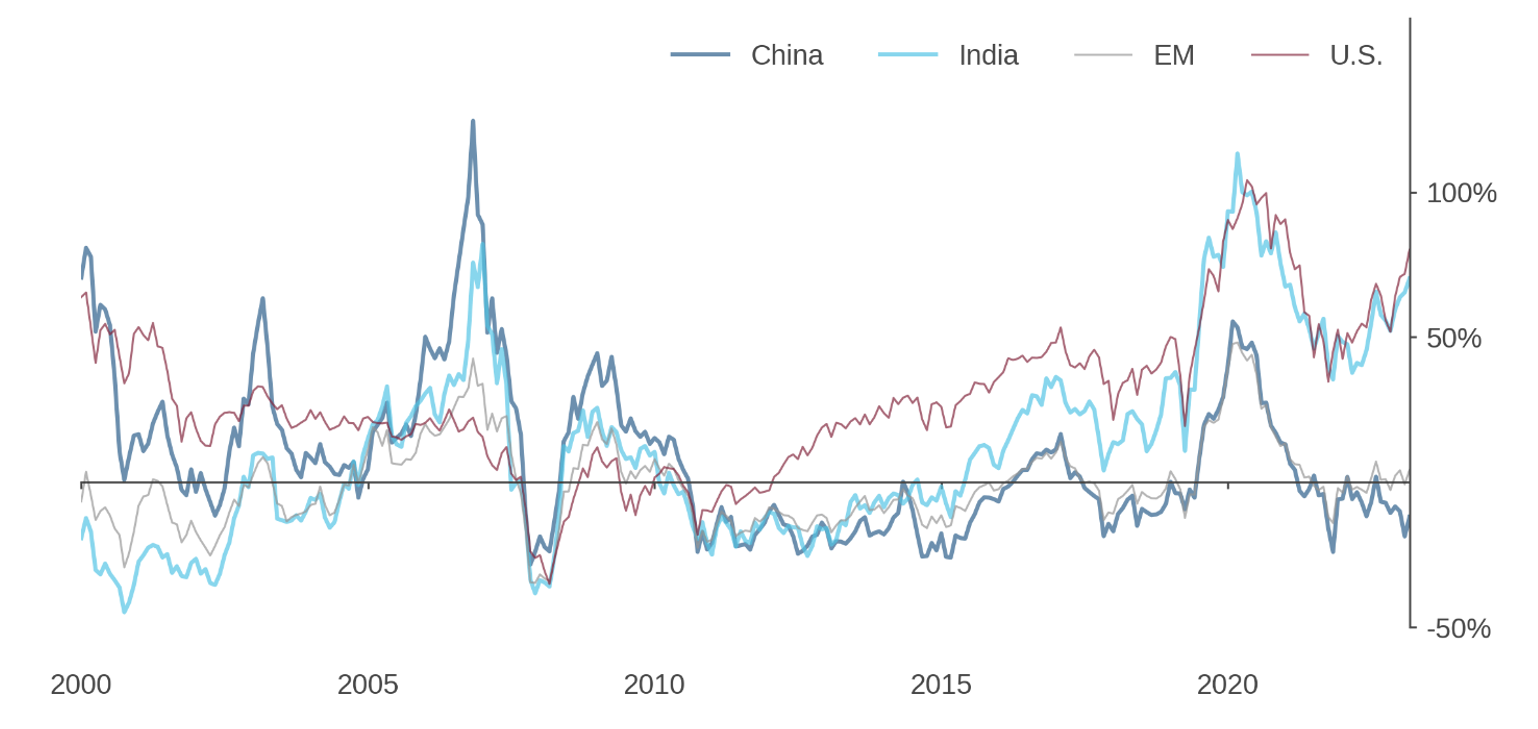

But divergent macro trajectories do not necessarily imply a promising investment opportunity. Economic optimism about India and pessimism about China are broadly reflected in market valuations. Indian equities trade at a substantial premium to fundamentals, close to what we are seeing in the U.S. (Figure 1). In contrast, Chinese equities trade at close-to-historic valuation discounts, which reflect the concerns about growth, not to mention other risks, including geopolitics.

Figure 1: India versus China—Divergence in Valuation Premia

Composite valuation premium based on several metrics relative to their long-term averages

The rise to prominence of Rising Tiger, Falling Dragon, like other EM investing themes that have preceded it, including BRICS, BATTS, and the Fragile Five, to name just a few, does not represent a nuanced view.1 It has been propelled by price patterns that have already manifested in markets. While it is certainly possible that those trends will persist, key judgments that should be on the minds of thematic investors are 1) whether the market is now under- or overvaluing the broad economic outlook and 2) whether they can time the further evolution of sentiment (perhaps, even, to find a “greater fool”).

Such assessments are hardly trivial. In fact, investors may recall that roughly a decade ago India was part of the Fragile Five EM investing theme, which decried a group of countries then viewed as vulnerable to exogenous economic shocks. At the time, there was fear that the Indian economy was vulnerable to capital outflows and, as a result, financial instability. In retrospect, Indian equities then traded at attractive valuations, weighed down by investor sentiment that was, with the benefit of hindsight, too negative.

India and China: Don’t Ignore the Cross Section

In chasing broad macro themes, investors often focus on high-level views and overlook variation in fundamentals within the cross section, neglecting opportunities for near-term stock selection. Rising Tiger, Falling Dragon is no exception. Investors who embraced the theme without scrutinizing variation in fundamentals within each market left opportunity on the table: fundamentally grounded signals, including value and quality, have paid off handsomely in both India and China.

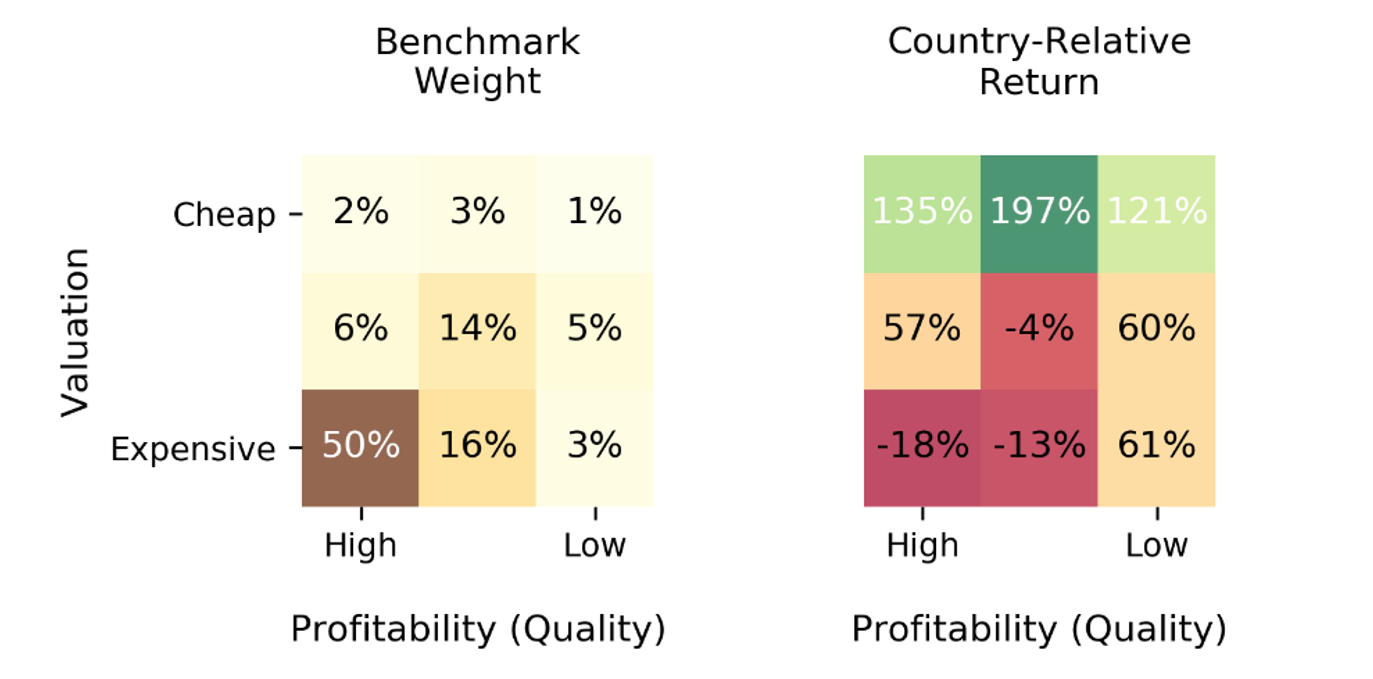

In India, thematic investors that allocated via country baskets have earned strong returns since 2021, roughly 60% (USD). Yet they could have done even better by tilting towards cheaper, higher-quality stocks. That is because, as shown in Figure 2a, the cap-weighted country basket has been heavily weighted in high-quality but expensive names (left panel), and those stocks have underperformed (right panel).

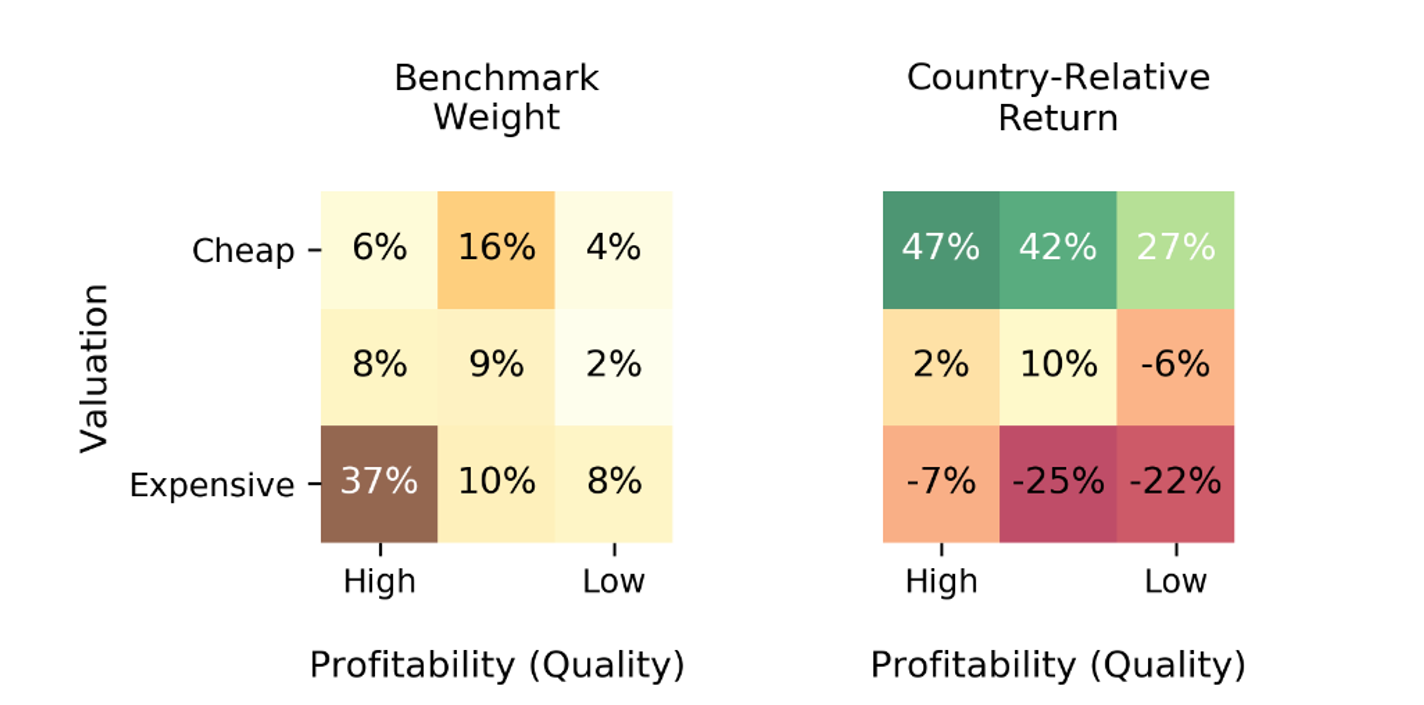

In China, macro concerns not only depressed index returns (-46% USD since 2021) but also prompted thematic shorts. Investors who held negative views on the country would have benefited from relative underweights in or by shorting expensive, lower-quality companies rather than expressing the bearish view through the cap-weighted basket. Figure 2b shows that in the MSCI China IMI Index, higher-quality stocks have had a substantial weight, and they have held up relatively well, even expensive ones. Stocks that were both expensive and lower quality have suffered the greatest losses.

Figure 2: Benchmark Weights and Returns by Value and Profitability Terciles

Stocks in each country sorted independently on the basis of valuation and profitability

Panel a: India

Panel b: China

EM Investing: Are We Tired of Memes Yet?

The EM domain seems especially prone to theme-driven investing, and it does not serve investors well. First, thematic macro investing, almost by nature, implies embracing narrow bets and timing market sentiment. For a recent reminder of the level of risk that this entails, we need look no further than at the fortunes of the BATTS.

Over roughly a four-year stretch, from 2017-20, these mega-cap EM tech stocks ran-up 30% p.a., easily beating benchmarks. When the BATTS-centric growth theme ended in late 2020, however, investors lost close to a quarter of their prior three-year outperformance in about forty trading days.2 What’s more, investors who held on to these growth stocks for another year ended up forfeiting the bulk of their prior gains. The suddenness and severity of the reversion highlights the challenge of timing themes.

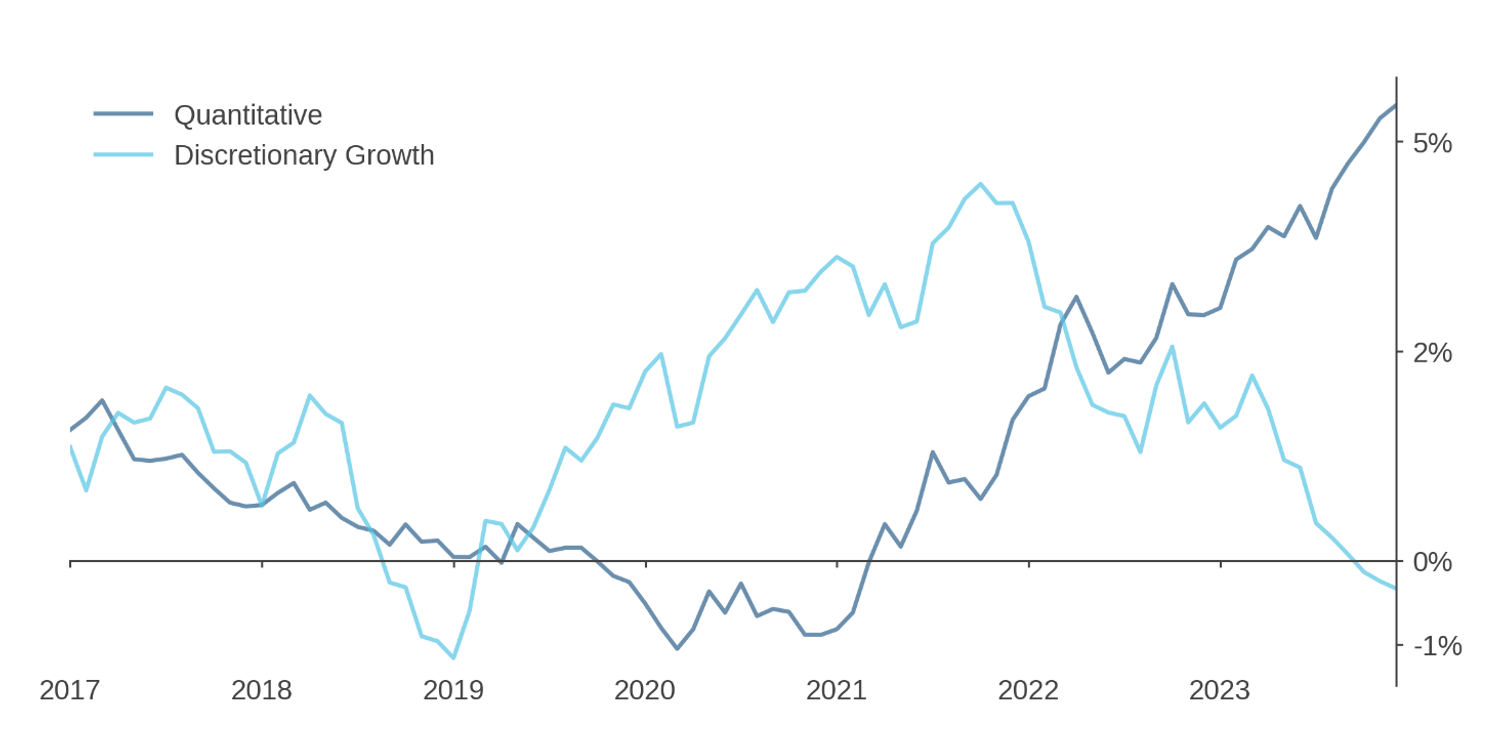

Figure 3 captures the rise and fall of the BATTS through active manager performance. The light blue trace shows the active returns of discretionary, growth-oriented managers, many of which leaned into the BATTS. They first delivered historically uncharacteristic excess returns, but that excess performance evaporated as the BATTS melted down.3 In contrast, performance of broader stock selection-based strategies that seek to harvest cross-sectional mispricings were to some degree anti-correlated with the theme, arguably harmed by market distortions as sentiment overwhelmed fundamentals. Over the full period, however, they have performed substantially better, especially as frothy sentiment unwound over the past few years.

Figure 3: The Rise and Fall of BATTS

Rolling 36-month average medial excess return versus MSCI EM benchmark

Moreover, even if the view implicit in a theme proves correct, its narrow conceptualization or implementation may not maximize participation in the underlying opportunities that are driving it. For example, part of the motivation for bullishness over India is rooted in hopes that the country’s economy will benefit from reglobalization, i.e., the expectation that companies will diversify supply chains as a result of lessons learned from COVID and ongoing tensions between the U.S. and China. But rather than expressing the reglobalization theme through India alone, why not spread the bet across EM and beyond—e.g., to Mexico and other countries in Latin America as well as to Vietnam—to improve the odds of benefitting from the trend? We believe that it is still unclear who will benefit most from the reconfiguration of global trade networks.

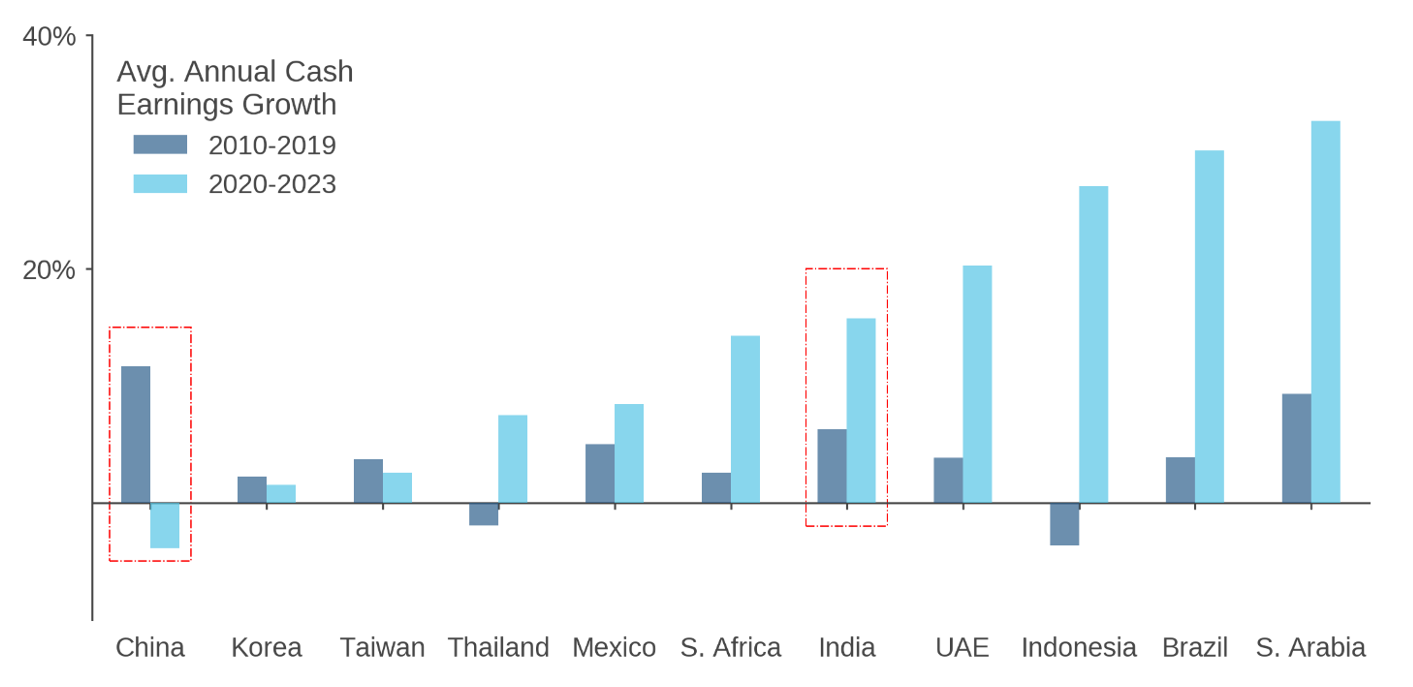

More broadly, trends in fundamentals that have helped to fuel the Rising Tiger, Falling Dragon theme have manifested elsewhere in EM. Figure 4 shows that, echoing the pattern in China, Korea and Taiwan have also suffered declines in earnings growth in recent years. Meanwhile, several smaller EMs have enjoyed even greater increases in earnings growth than India, including consumption-oriented markets like Indonesia and South Africa and commodities-driven economies, like Saudia Arabia and UAE. The point is that macro-driven opportunities associated with Rising Tiger, Falling Dragon may be available elsewhere in the full EM country cross section. And in casting a wide net for such opportunities, we would also advise investors to carefully factor in valuations and sentiment, not just economic or fundamental growth.

Figure 4: Shifts in Earnings Growth across EM

Average annual cash-earnings growth by country

Conclusion

Might it still be worth embracing the Rising Tiger, Falling Dragon theme? Possibly. But the risk is hardly trivial, and evaluation of the trade should be based on much more than just extrapolation of prior returns or even the macroeconomic picture.

More broadly, based on our experience in EM, we would encourage investors to look past the trendy themes that have come and gone in the asset class. The full cross section of EM stocks offers a consistently rich reservoir of mispricings for sophisticated managers to exploit. Instead of timing narrow themes, stay invested, stay diversified, and embrace active strategies that cast a wide net and employ a broad information set.