Opportunity Beyond U.S. Shores

Key Takeaways

-

We encourage U.S. investors to look beyond their shores and consider opportunities in international equity markets.

-

EAFE and EM equities look appealing relative to the U.S. on a valuation basis. Growthy speculation that has particularly benefited the U.S. has not fully abated. Value stocks look unusually cheap outside of the U.S. and especially in EAFE.

-

While the dollar’s strength in recent years likely dissuaded some U.S. investors from allocating overseas, that headwind may have ebbed.

Table of contents

For more than a decade after the Global Financial Crisis (GFC), U.S. equities dramatically outperformed international markets. Dating back to 2010, MSCI’s U.S. benchmark has delivered an annualized total return more than twice that of EAFE and more than four times that of EM.1 That run of dominance left many investors with regret over non-U.S. allocations and, in many cases, an uncomfortable task of defending them.

Nevertheless, we caution investors not to chase this past performance in their allocations. In fact, in present context, we believe international equities look comparatively attractive relative to the U.S. on the basis of valuations. Moreover, an era of dollar appreciation, which likely dissuaded U.S. investors from allocating overseas, may be ending.

Risks of Chasing Past U.S. Performance

Based on the U.S. market’s dominant run after the GFC, many investors despaired of being adequately rewarded by foreign holdings and narrowed their focus to the U.S. But such periods of dominance inevitably end, sometimes abruptly.

As a cautionary example, consider Japan in 1990. After five years of spectacular outperformance amid popular narratives anointing the country as the next economic superpower, how many investors predicted—and were willing to put money behind the view—that Japan would massively underperform the global market over the next decade?

Moreover, in an investment industry plagued by short memories, how many investors recall that from 2003 to 2007 EAFE and EM outperformed the U.S. market by over 9% and 22% per annum, respectively?

Such examples highlight the risks of allowing past performance to over-influence regional allocations.

International Equities: Attractive Valuations

At present, international equities look attractive relative to the U.S. on the basis of valuations. By one measure, the U.S. equity market recently has grown so expensive that the cap-weighted index offers little compensation for bearing risk. As the grey trace in Figure 1 shows, U.S. forward earnings yields are barely above returns on cash, the margin having plunged to its lowest level since the TMT bubble 20 years ago. By contrast, in key EAFE countries and in EM they remain several points above short-term interest rates and unexceptional by historical standards.

Figure 1: Valuations — Forward Earnings Yields Minus Short-Term Interest Rates

Data through April 2023

Several related factors have contributed to this divergence across geographies. First, U.S. price-to-earnings multiples have expanded apace with other regions even though the Federal Reserve has tightened more aggressively than other central banks.

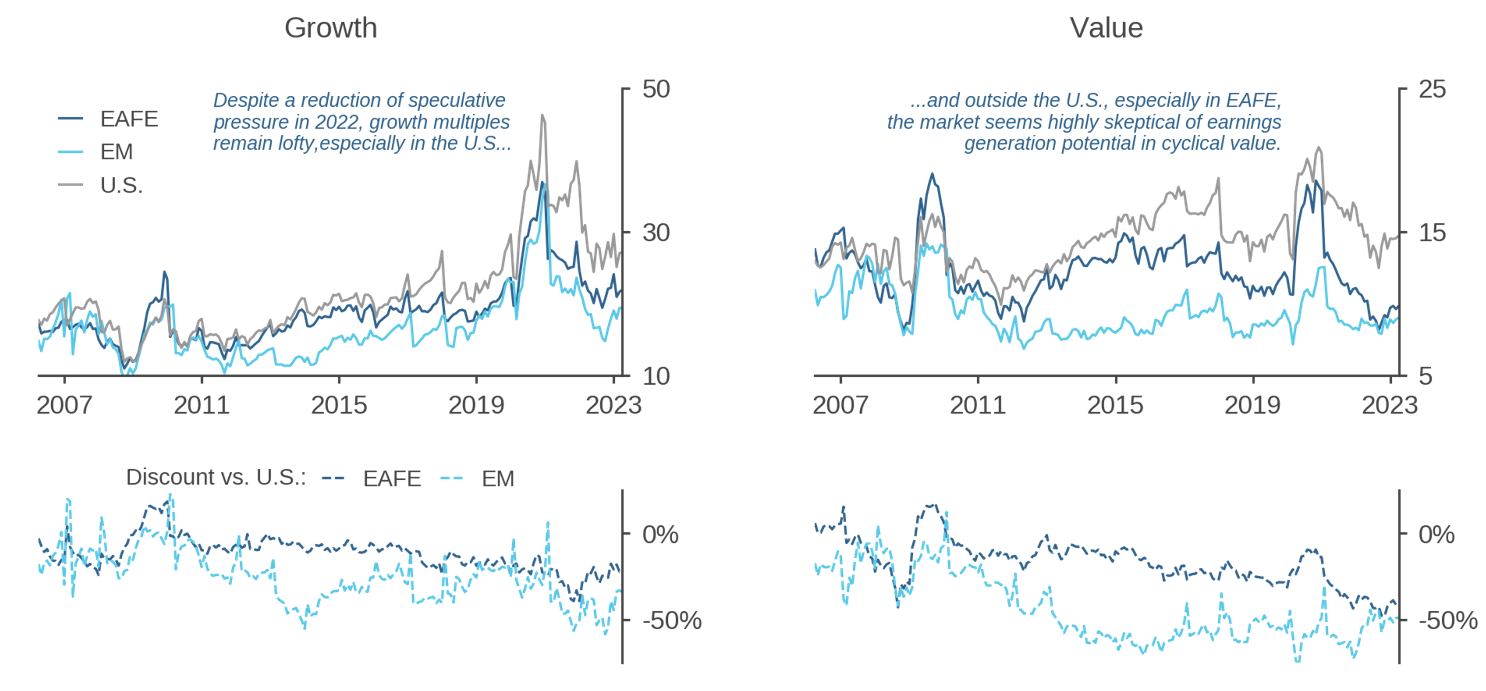

Second, speculative pressures in growthy assets that built up from 2017 to 2021 have not fully abated, despite the 2022 market drawdown. The tech-heavy U.S. was the epicenter of that speculation, a “one-factor bet on growth” that we’ve chronicled extensively in prior research.2 Growth multiples there remain lofty both by historical standards and relative to EAFE and EM. (Figure 2, left panel)

Figure 2: Price to Forward Earnings Ratios

Data through April 2023

Finally, value has become historically cheap in EAFE. Relative to the U.S., the forward P/E for value in EAFE is as low as it has been in at least 15 years. (Figure 2, right panel) The market seems deeply skeptical of earnings generation potential in non-U.S. value stocks, perhaps in part due to the elevated geopolitical uncertainty and comparatively severe deterioration in consumer and business sentiment that was inflicted on Europe by the war in Ukraine.3

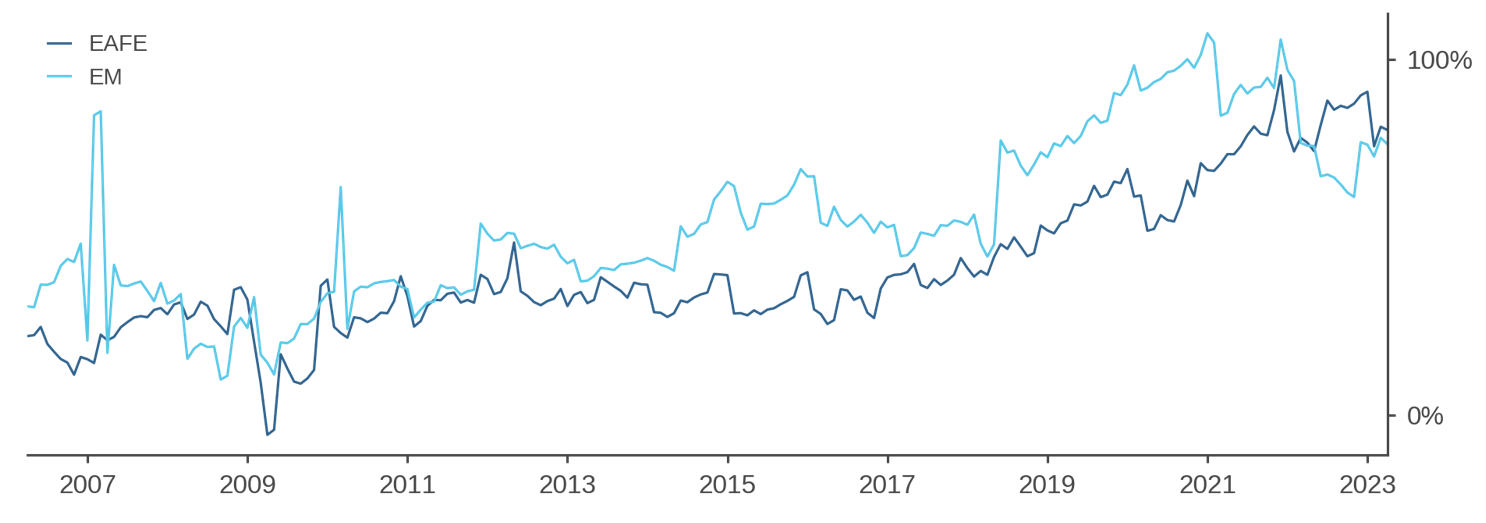

Given this environment, we believe that the balance of risks favors EAFE and EM allocations relative to the U.S. Moreover, a corollary of this view is that value-oriented investing approaches currently look appealing in those international markets. As evidence, Figure 3 combines the relative expensiveness of growth and cheapness of value from the bottom panels of Figure 2 into a single metric. The chart shows that growth multiples in both EAFE and EM are historically elevated relative to value multiples, which suggests an attractive opportunity set for active strategies that seek to benefit from reversion of mispriced fundamentals.

Figure 3: Growth to Value Premium in International Markets

Data through April 2023

Dollar Headwinds Ebbing?

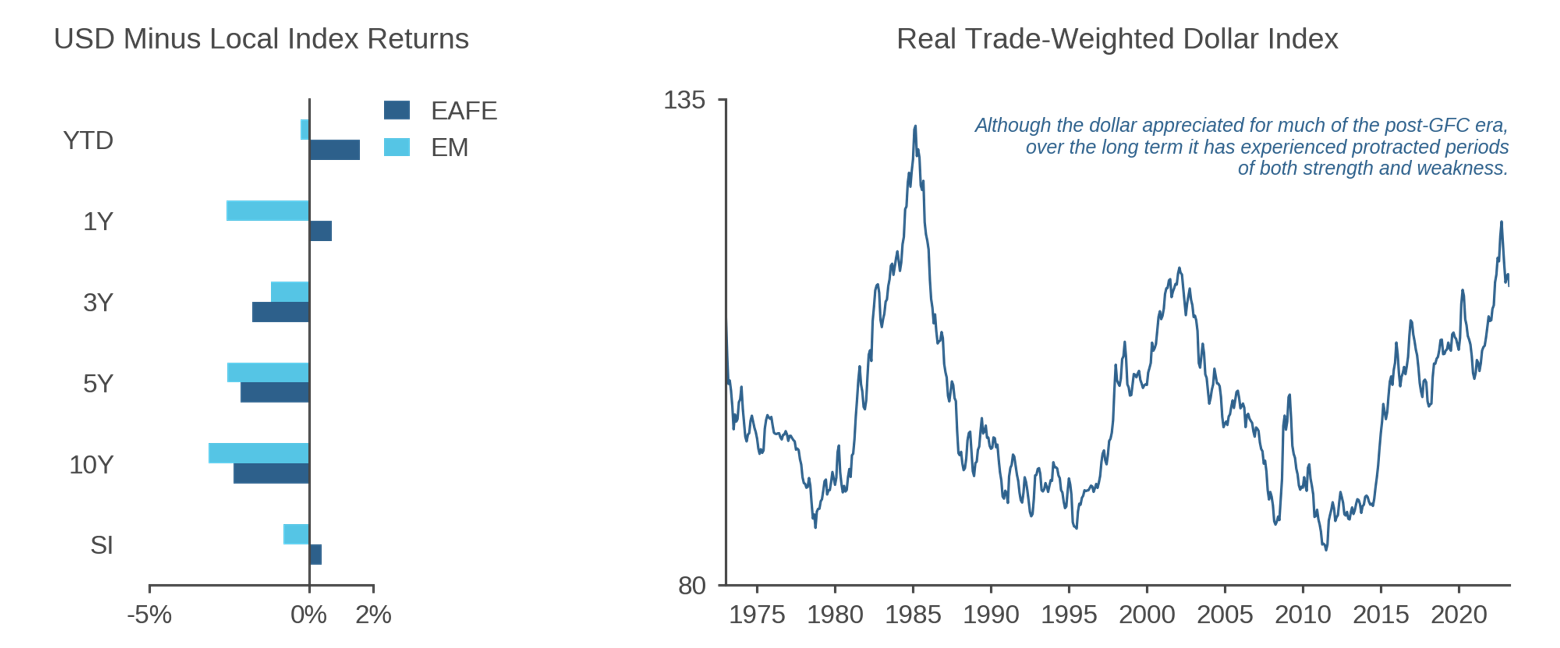

For many years, an appreciating dollar eroded the performance of unhedged overseas equity allocations for U.S. investors. For example, during the first year of the Federal Reserve’s aggressive hiking cycle, from March 2022 to February 2023, the dollar’s strength reduced unhedged USD EAFE returns by more than 8%.4 More broadly, as Figure 4 shows, dollar appreciation and its consequent negative impact on international equity returns was for many years a consistent feature of the post-GFC environment.

Figure 4: Post-GFC Strength of the U.S. Dollar and its Impact on USD-Based Returns

Data through April 2023

But we do not see the post-GFC experience as representative of what investors should expect going forward. Returning to the left panel of Figure 4, while USD-based versions of EAFE and EM have trailed local currency versions of the indexes for many holding periods of up to a decade, the bottom bars of the chart show that since-inception returns, which start in 2001, are quite similar. Consistent with that observation, the long history of the Real Trade-Weighted Dollar Index (right panel) shows protracted periods of dollar depreciation as well as appreciation. In other words, while dollar appreciation has in recent years eroded USD returns on international investments, it has at other times provided a tailwind.5

In fact, the currency headwind has diminished during the first part of 2023. The dollar has softened against other major currencies since late 2022 as the U.S. inflation outlook has cooled, sparking expectations that the Federal Reserve might be closer to the end of its tightening program than the ECB or BOE. Although currency markets remain highly sensitive to macroeconomic data and central bank messaging, our Multi-Asset Strategies team’s near-term forecast for the dollar versus other DM currencies remains modestly bearish, reflecting the relative impacts of falling commodity prices, monetary policy, and inflation.

Conclusion

Pressure to chase the dominant performance of growthy U.S. equities during the post-GFC environment left some U.S.-based investors underexposed to investment opportunities beyond their shores. With an era of low interest rates apparently at an end, we believe that U.S.-based investors should revisit the case for international equities afresh and value-oriented active approaches in particular.