Taking the Heat Out of Decarbonization Strategies

Key Takeaways

-

Neither exclusion-based approaches nor low-carbon benchmark tracking indexes incorporate a deliberate means of generating alpha.

-

Exclusion-based approaches tend to rely on industry allocation bets that generate substantial uncompensated risk.

-

In contrast, we show that combining a rich stock-selection model with sophisticated portfolio construction may durably improve financial outcomes while meeting decarbonization objectives.

Table of contents

Poor year-to-date returns of many low-carbon equity strategies have called into question the financial wisdom of conventional methods of achieving sustainability objectives. In the following we examine the drivers of that disappointing 2022 performance and demonstrate an approach designed to provide superior financial outcomes.

We first examine shared characteristics among mainstream decarbonization strategies that are available in the marketplace. Many of these strategies employ blunt industry reallocations to modify their carbon profiles and, in doing so, take on active industry exposures. In our view, these exposures represent a form of uncompensated risk that for years provided an incidental performance tailwind but in 2022 has generated a significant headwind. Another class of decarbonization strategies hugs the benchmark, better controlling for industry risk but also generating minimal active return, essentially by design.

We then demonstrate the benefits of incorporating an active return-seeking objective and more sophisticated portfolio construction into a low active risk decarbonization strategy. Relative to conventional alternatives, we show that this approach generates more durable alpha from stock selection while both minimizing uncompensated risks and meeting decarbonization targets.

Decarbonization Strategies: Distinguishing Characteristics

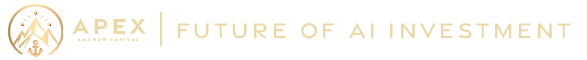

Over the past decade, investment strategies that limit exposure to carbon delivered generally attractive investment returns. In 2022, however, many have underperformed market indexes. To better understand what has driven the shift in performance, Figure 1 highlights salient characteristics of a broad sample of asset managers’ low-carbon global equity offerings drawn from the Refinitiv Ownership database. Based on their names and other basic attributes, we group the strategies into four categories:

-

Paris Aligned: The objective of these strategies is to reduce carbon exposure without regard to maximizing returns.1 Paris Aligned strategies incorporate strict fossil fuel-related exclusions, which achieve a 73.5% benchmark-relative reduction in weighted average carbon intensity (WACI) through material underweights to the energy and materials sectors. From a financial perspective, these strategies have been the worst underperformers in 2022.

-

Climate Transition: These strategies aim to be well positioned for a transition to a more climate-friendly global economy. While they invest in alternative energy, they also invest in carbon-inefficient companies that may have the most to gain from a transition. Perhaps surprisingly, as a result, Transition strategies tend to have materially higher carbon exposure than the benchmark by some measures (e.g., median +78.5% WACI). From an allocation perspective, they have material overweights to utilities.

-

Low Carbon: Strategies in this group lie between the Climate Transition and Paris Aligned categories in terms of their benchmark-relative carbon exposure. To achieve a median 41.9% WACI reduction, they typically underweight energy companies but have small overweights to utilities and, consequently, some exposure to fossil fuels.

-

Low Carbon Enhanced Indexes: These strategies differ materially from the others with respect to objectives and methods. They are aimed at investors who wish to decarbonize but who have limited appetite for active risk. Specific approaches vary, but they are often based on security-level exclusions, constraints on portfolio-level exposures implemented through optimization,2 or some combination of the two.3 Low Carbon Enhanced strategies are often systematic, as is evident in their large number of holdings. While they are effective in generating large carbon reductions with smaller sector reallocations, as a group they have still underperformed the benchmark index.

Figure 1: Asset Managers’ Decarbonization Offerings—Salient Characteristics

While the strategies represented in Figure 1 may deliver on their varied sustainability objectives, we believe that investors who are focused on financial performance and active risk should consider more sophisticated approaches. Specifically, we would advocate for incorporating an explicit returns-seeking element in the form of stock selection. Figure 1 provides specific motivation beyond the general underperformance of the conventional strategies in 2022: the typical strategy in each category has negative active exposure to CCAT’s stock selection alpha signals relative to the cap-weighted benchmark. In other words, it has relatively undesirable exposure to Value, Quality, Growth, and Technical characteristics that have been shown, over the long term, to improve returns.

Achieving Better Financial Outcomes

To flesh out the choices involved in decarbonizing, we compare an approach that incorporates CCAT’s return model with two baseline strategies that embody salient features of the available offerings studied in Figure 1.

-

Baseline #1 Rules Based: This hypothetical strategy excludes securities from the MSCI World Index based upon revenue exposure to fossil fuels. In the specific implementation, we apply commonly accepted fossil fuel exclusion criteria using the Paris Aligned Benchmark methodology.4

-

Baseline #2 Carbon Constrained: This hypothetical strategy applies systematic portfolio construction techniques to explicitly target a reduction in portfolio-level carbon exposure while limiting active industry exposures and minimizing overall active risk.5 To ensure like-for-like comparisons across approaches, we constrain WACI to the average reduction achieved by the Rules Based strategy, -34% versus the benchmark. The CCAT-based approach, which we label Active Enhanced, maximizes risk-adjusted returns using our stock-level return and risk forecasts while targeting the same WACI reduction as the two baselines.

The Active Enhanced hypothetical strategy targets 20bps of active risk, consistent with Carbon Constrained strategies. In the last section, we offer perspective on higher active risk contexts.

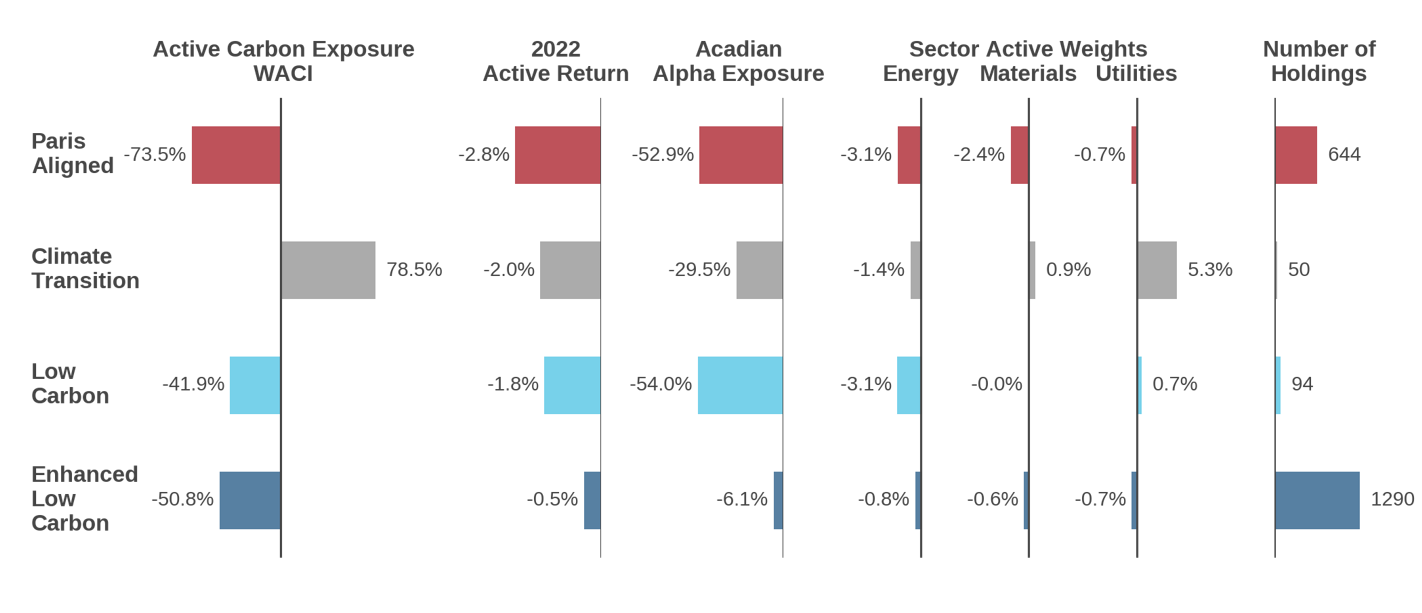

In a hypothetical historical analysis from 2010 – July 2022, all three strategies deliver similar ex post carbon reductions, as intended.6 But Figure 3 shows that the three decarbonization approaches produce materially different financial outcomes.

Figure 2: Hypothetical Decarbonization Strategies—Key Attributes

.png)

Figure 3: Hypothetical Cumulative Active Returns

Specifically, the Active Enhanced strategy provides a stream of positive active returns. The Rules Based baseline delivers a cumulatively positive active return, but its benchmark-relative performance is volatile and exhibits significant drawdowns, including during 2022. The Carbon Constrained baseline generates minimal outperformance, which is hardly surprising given that it is more or less designed to neither under- nor outperform, minimizing active risk with no alpha-generation driver.

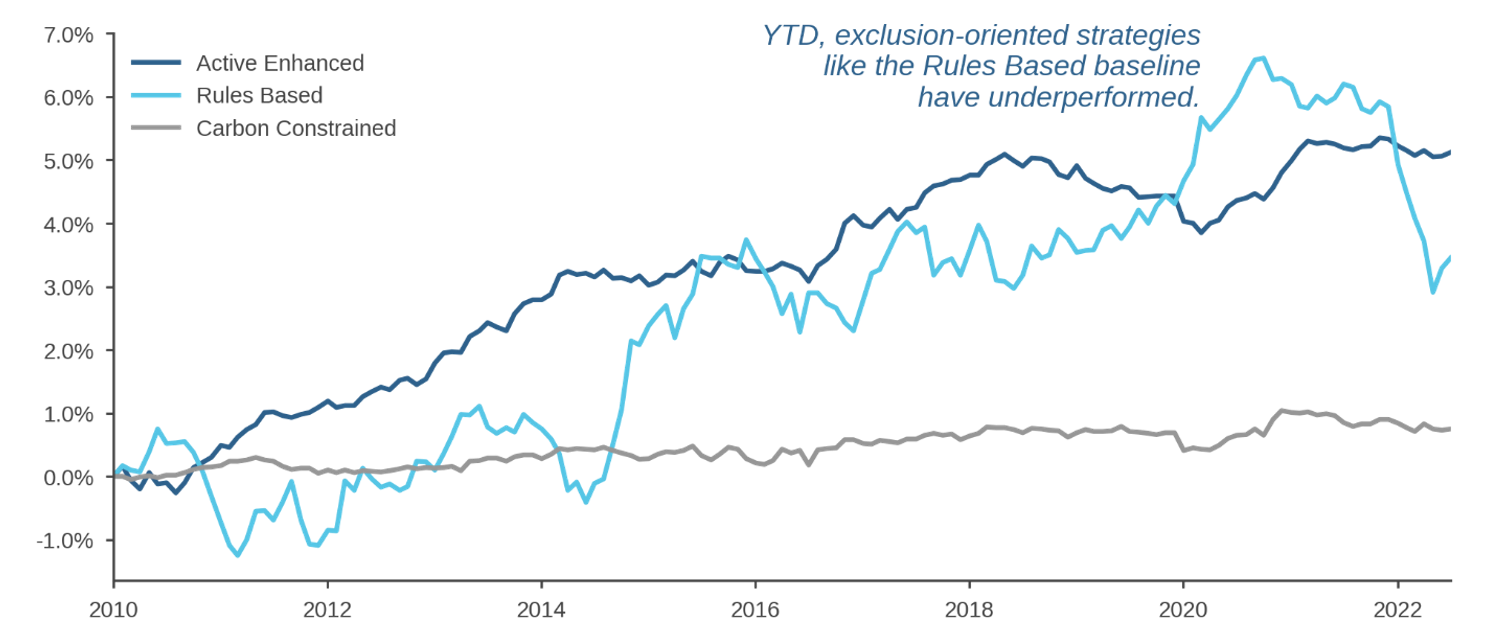

A returns attribution in the left panel of Figure 4 identifies key sources of discrepancy. The Rules Based approach achieves most of its outperformance through active industry allocation bets (dark blue shading). In contrast, outperformance of the Active Enhanced strategy is driven by stock selection (gray), consistent with the design decision to maximize exposure to CCAT’s bottom-up return signals. Drilling deeper, the right panel of Figure 4 shows that relative to the Active Enhanced strategy, both the Rules Based and Carbon Constrained baselines have small and sometimes negative active exposure across all four signal groups in our stock-selection model. Close inspection of the left panel shows that the Active Enhanced strategy delivers its higher active returns even though inclusion of the alpha model generates higher trading costs (gold) associated with increased turnover relative to the other two approaches.7

Figure 4: Hypothetical Active Returns Analysis

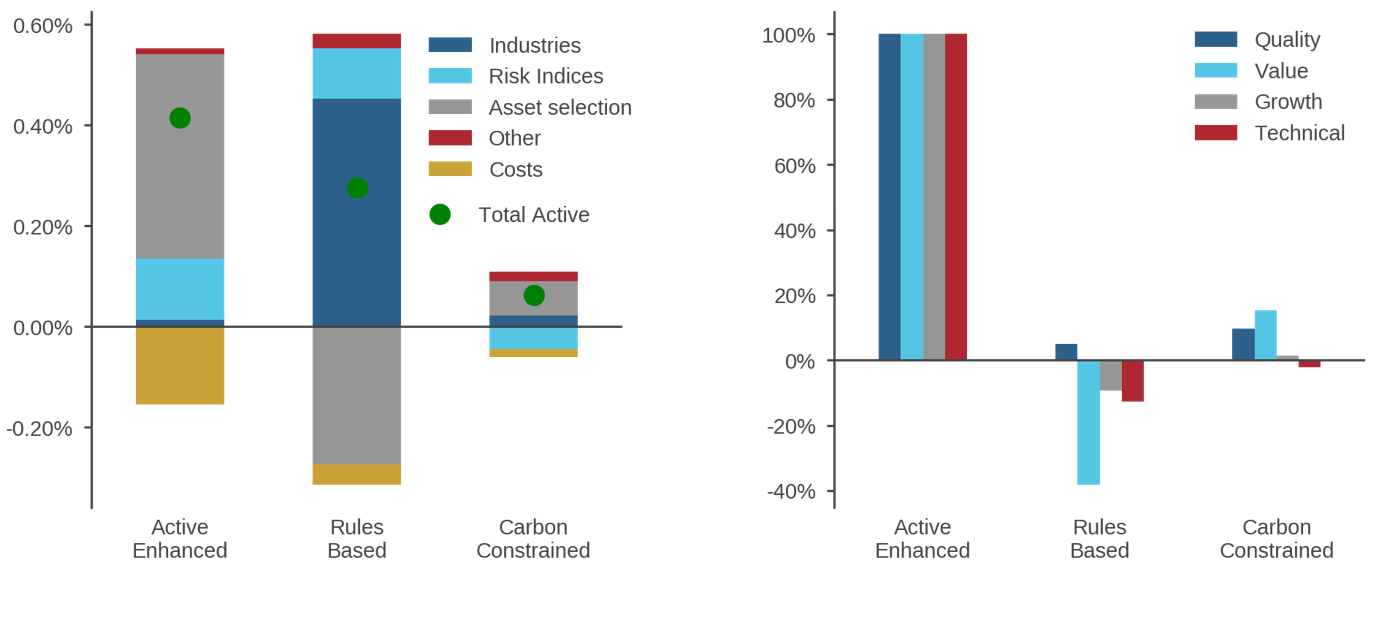

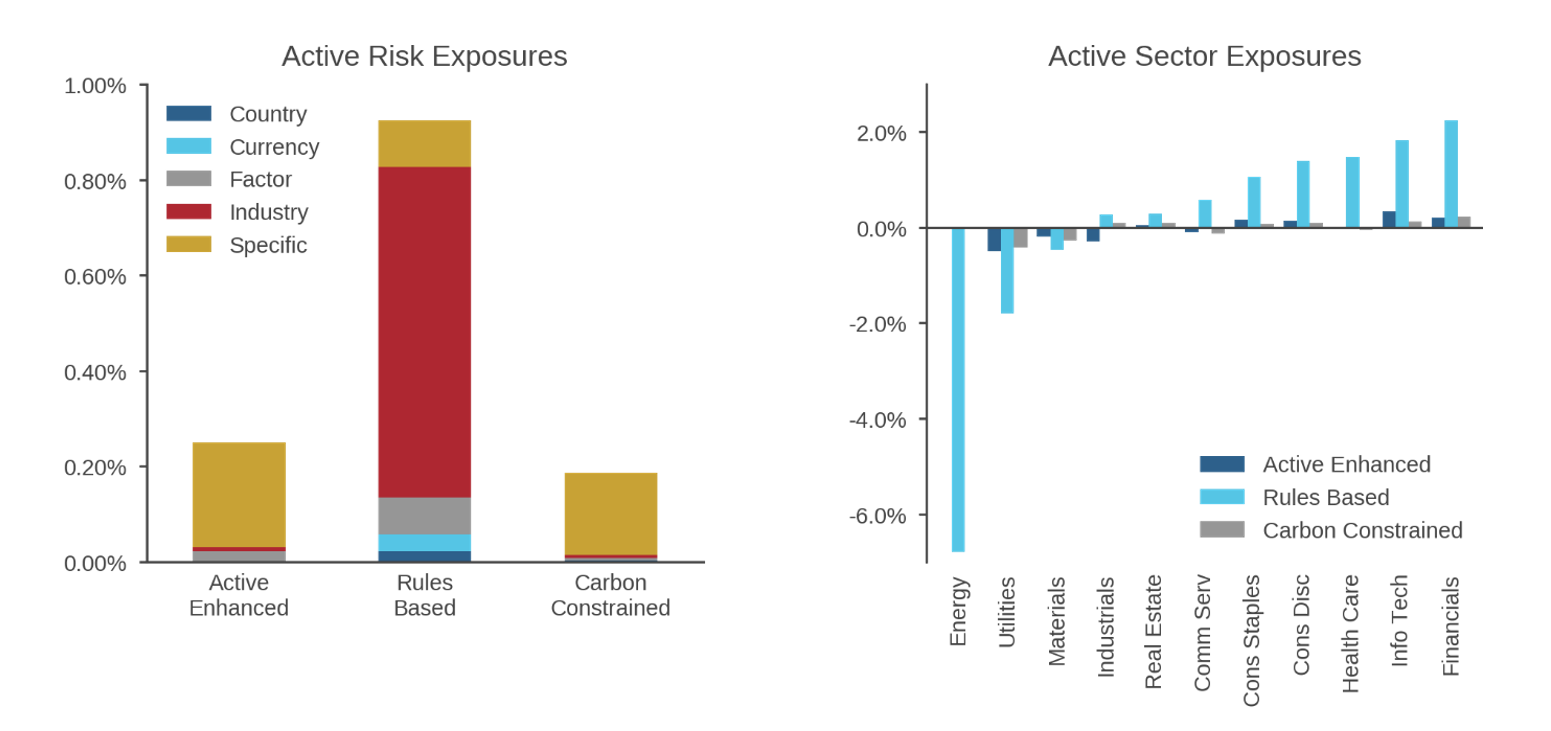

The importance of whether active returns derive from industry allocation or stock selection is driven home by a risk attribution in Figure 5. The left panel shows that the Rules Based approach generates ex ante active risk of 0.90% on average over the simulation period, more than three times the levels exhibited by the Carbon Constrained and Active Enhanced strategies, both of which tightly control ex ante active risk exposure from a wide range of systematic factors.

Figure 5: Contributions to Hypothetical Ex Ante Active Risk

The right panel documents that most of the active risk associated with the Rules Based approach represents industry exposures that result from the blunt fossil-fuel exclusions. In other words, the Rules Based strategy’s active returns will almost entirely depend on the future relative performance of the affected industries, including both the underweighted energy and utilities sectors and the overweighted financials and technology sectors. Moreover, as we have noted in prior research, the active risk of decarbonization strategies that primarily rely on industry reallocations may vary considerably over time because these strategies do not generally include mechanisms to modulate exposures to affected sectors or industries as their volatilities rise and fall.8

Flexibility of Active Systematic Approaches

The hypothetical analysis described above compares three low-carbon implementations in a low active risk context. In that setting, the Active Enhanced approach offers additional benefits. Its flexible portfolio construction machinery can be tailored to an investor’s specific decarbonization objectives, other sustainability goals, and financial requirements, and it is designed to optimize the tradeoffs between them.

Moreover, moving away from the low active risk setting, additional analysis emphasizes the benefits of incorporating active stock selection as the active risk constraint is relaxed. In essence, given the current composition of most equity benchmarks, a well-conceived systematic active strategy can achieve significant portfolio decarbonization with little sacrifice in terms of alpha exposure.9 All the more reason not to neglect alpha generation in decarbonizing allocations.

Conclusion

At certain points in time, the choice of decarbonization implementation within enhanced investment strategies has not materially detracted from financial outcomes. In fact, some approaches have episodically benefited from an incidental tailwind. The year 2022 has shown the risks of such indifference, however. The current environment has highlighted the need to understand the drivers of a strategy’s observed active performance. Approaches that employ more sophisticated portfolio construction rather than defaulting to blunt exclusions, in our view, can better control for unintended risk exposures resulting from carbon reduction. To durably generate active returns, strategies should also include a sophisticated stock selection component.