Environmental Themes in Commodities Investing: Systematic Macro Perspective on ESG

Table of contents

CCAT’s Director of Client Advisory, Seth Weingram, recently met with Mike Ponikiewicz, our lead commodities PM, to discuss how environmental and other ESG themes are influencing markets and how we invest in our systematic macro strategies. The Q&A below summarizes the conversation.

SW: Can environmental themes be integrated into systematic macro strategies?

MP: Conventional wisdom holds that systematic macro investing is more or less blind to ESG considerations. Not only is that perception incorrect, but we believe that it’s increasingly important for systematic macro strategies to adapt naturally to environmental and other ESG themes. Commodities stand out in this regard, because their production and consumption are tightly intertwined with ESG-related considerations, and because in forecasting commodity returns, the balance of supply and demand in the physical market represents a key input. Physical market conditions will react to environmentally related influences, including shifts in consumer preferences, changes in production costs, or supply constraints arising from regulatory action.

Industrial metals provide a helpful illustration. Over the years, their demand profiles have evolved with the shift in industrial structure from “old economy” metals such as zinc, which is used in rust proofing and steel, towards “new economy” metals like copper, which is used in wiring, and tin, which is used in circuit boards and semiconductors. Environmental considerations have long contributed to demand for aluminum, which has been used for years to improve fuel efficiency by making vehicle components, like engine blocks, lighter. And now we’re seeing an environmental influence on demand for nickel, which is used to make batteries for electric vehicles (EVs) and other energy storage applications.

In the investing context, failing to account for these trends could risk a distorted perception of fair value for various industrial metals. In a systematic investing process, that puts a premium on developing signals and other process elements that can naturally adapt to ESG themes as their influence on markets evolves. Doing so requires attentiveness to the unique economic and market features of individual commodities.

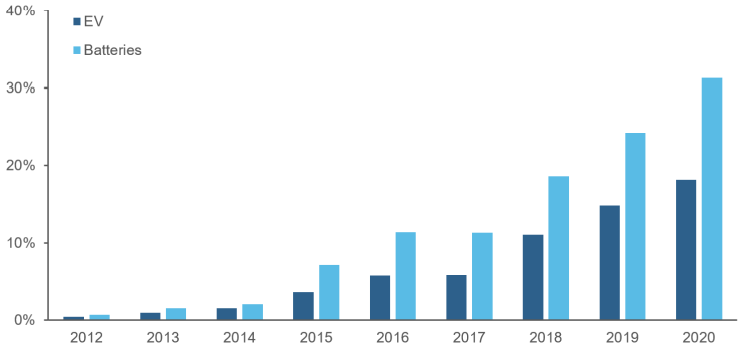

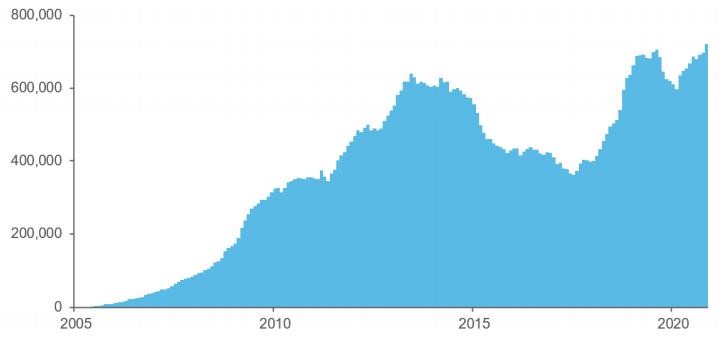

Returning to nickel as an example, while demand associated with EV production is growing (Figure 1), it hasn’t yet reached a level that would put the physical market for the metal into persistent deficit. In the meantime, though, nickel prices are prone to speculative rallies on EV news in the context of a market that’s still in surplus.

Figure 1: Demand for Nickel Attributable to Electric Vehicles and Batteries

A takeaway from this example is that ESG investors should embrace the sophistication that’s required to capture the full complexity of the relationship between environmental themes and commodities prices.

SW: Is an ESG orientation inherently inconsistent with investing in commodities?

MP: Conventional perceptions of commodities investing have been overinfluenced by passive implementations that treat commodities as a monolithic block. For environmentally sensitive investors, passive long-only commodities allocations raise concerns. They contribute to net demand for all commodities, including those associated with environmental harm—through carbon emissions or deforestation—and with potentially adverse social and governmental impact, e.g., by causing upward pressure on food prices. Moreover, popular multicommodity benchmark indexes are weighted by historical share of global production and market liquidity. As a result, they naturally channel particularly large allocations to the petroleum sector, which accounts for the greatest share, by far, of global commodities production and liquidity.

In addition to ESG concerns, we believe that passive long-only commodities investing approaches are also inferior from a financial perspective. They presume that indiscriminately buying commodities provides a long-term returns premium, and they fail to deliver the full investing potential of the asset class in terms of both absolute returns and diversification.

In our view, highly active long-short commodities investing represents a superior approach. Specifically, we advocate 1) embracing the distinctiveness of different groups of commodities—e.g., the petroleum complex, industrial metals, precious metals, etc.—and 2) exploiting mispricings within those groups.

Aside from the financial motivations, the diversified long-short positioning generated through this approach also has a natural ESG benefit: It should result in a much smaller environmental footprint, reducing the indiscriminate net contribution to commodity demand relative to passive long-only investing approaches. Moreover, we can adapt systematic portfolio construction around specific ESG objectives and requirements. For example, the process is well-suited to exclude or constrain holdings in certain commodities while methodically rebalancing remaining long and short positions in order to mitigate the impact on the overall portfolio’s risk and expected return.

In summary, while investors may think that commodities are antithetical to environmentally sensitive investing, that’s not the case.

SW: What are our commodities models telling us about the impact of current climate change initiatives and related policies?

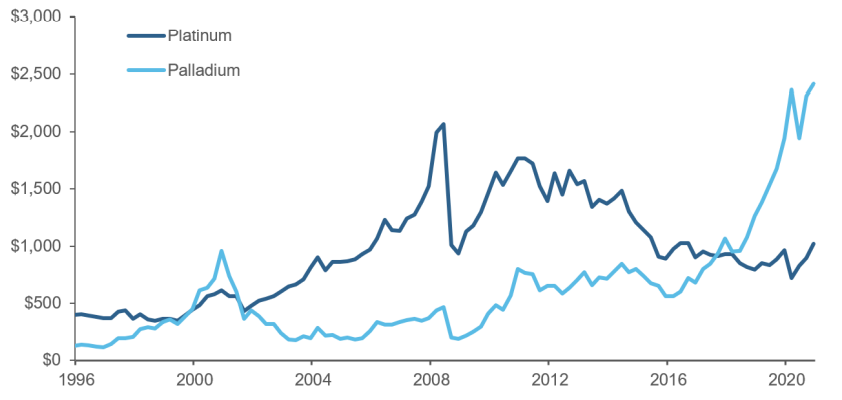

MP: We see considerable evidence that environmental policies are affecting commodities pricing through their influence on supply and demand. A fascinating example stems from the tightening of global emissions standards, e.g., “Euro 6” and “China 5,” which has driven a shift away from diesel engines in passenger vehicles to smaller displacement gasoline, hybrid, and, to an extent, electric-drivetrain engines. This has contributed to a significant reduction in demand for platinum-based catalytic converters, which are especially effective for diesel engines. It has also led to increasing demand for palladium, since palladium and platinum are similarly effective for gasoline engines. Over the past few years, this has contributed to a supply deficit for palladium that has sent its price soaring and to a surplus for platinum (Figure 2), particularly since the Volkswagen emissions-testing scandal in 2015 accelerated the trend away from diesel.

Figure 2: Palladium and Platinum Spot Prices per Ounce

Nevertheless, we should acknowledge the challenge of making such assessments with precision. Many factors affect commodities prices, and it’s not trivial to distinguish evolving expectations for policy change and policies’ influence on physical markets from other phenomena. In some contexts, in fact, the multiplicity of environmentally oriented policy changes has had confounding effects. In the context of diesel, for example, International Marine Organization (IMO) 2020 standards aimed at reducing the use of high-sulfur fuels in shipping (“bunker” fuel) actually triggered increased demand for diesel, which is comparatively low sulfur. Moreover, quantifying the impact of policy change in commodities is challenging because we don’t have a large number of underlyings to analyze in contrast, say, to the rich cross section of equities, so the evaluation may involve trying to disentangle coincident long-term trends.

SW: Has decarbonization impacted the petroleum sector, specifically? Is this apparent in supply and demand data?

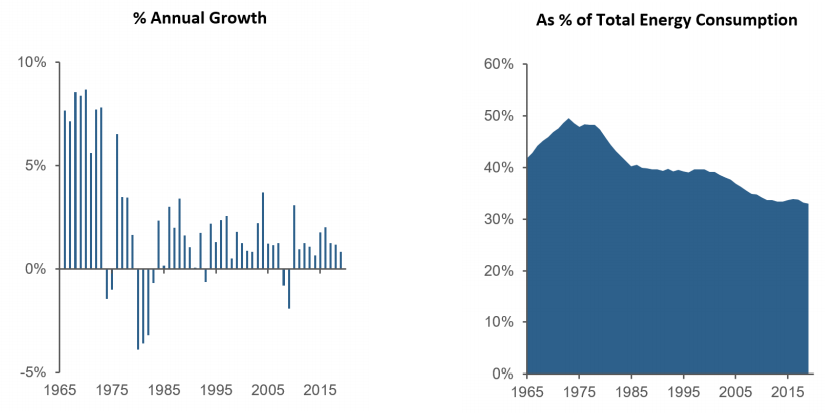

MP: Yes. There is evidence that decarbonization has reduced demand for petroleum. From the perspective of an environmentally conscious investor, though, the picture is mixed. The bad news is that the world’s total demand for oil has continued to increase. The good news is that the growth rate has stabilized and has lagged behind GDP growth. As a result, oil’s share of total energy consumption has been falling steadily for over 20 years. (Figure 3)

Figure 3: Long-term Trends in Global Oil Consumption

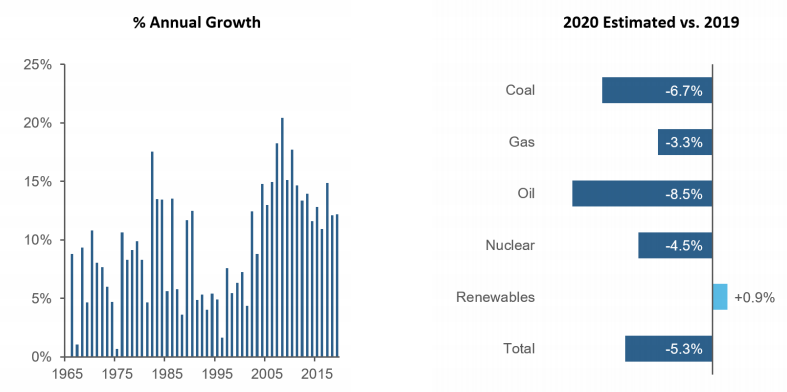

Renewables also offer evidence of decarbonization. They remain a small fraction of global energy consumption, less than 5%, compared to roughly 25% or more for each of natural gas, coal, and oil. But as encouraging datapoints, renewables consumption growth is strong, above 10% per year. Moreover, during the COVID crisis global demand for renewables held up and increased slightly, even as oil demand plunged by more than 8%. (Figure 4)

Figure 4: Trends in Renewables Consumption

SW: How do you see the commodity investment landscape changing 5 to 10 years from now as the mix of commodities used in the global economy evolves?

MP: Investors should expect that the commodity investment universe will evolve with the global economy. The investment relevance of different commodities will grow or diminish in relation to their economic value. Many factors drive change, including new technologies, changes in consumer taste, and policy. From the ESG perspective, in recent years, we’ve already seen environmental themes emerge as a material driver of change in commodities markets, and we expect that influence to grow given the number of policies in effect and in the pipeline – so to speak – across continents. Among the trends that we expect will be visible in the near term, demand for lower emissions in transportation will add liquidity and hedging demand for commodities that are used in batteries, like cobalt and lithium. We expect tradability of carbon itself to grow further; futures on European Carbon Emission Allowances have become a major market in little more than a decade. (Figure 5) We would also expect further growth in natural gas markets as a so-called “transition fuel” at the expense of oil and, particularly, coal, owing to natural gas’s greater carbon efficiency.

Figure 5: Carbon Emissions Futures Volumes

While there is growing momentum to address climate change in both policy and corporate spheres, with numerous initiatives in all major economies, the magnitude and timing of actions and their impact remains uncertain. But physical markets’ supply and demand profiles provide an important gauge of their effects.

SW: What does the evolving landscape mean for systematic commodities investing?

MP: A common misconception about systematic investing approaches, macro and otherwise, is that they’re blindly reliant on historical data to identify predictive signals. Such a perspective would seem at odds with ESG’s inherently forward-looking orientation. After all, ESG is motivated by desire to bring about change. While there are, indeed, simplistic rules-based investing approaches —smart beta and alternative risk premia strategies— that are based on a premise that the future will closely resemble the past, that assumption isn’t the premise of more sophisticated systematic approaches.

Instead, sophisticated managers apply forward-looking analysis and judgment in designing and maintaining their processes. We won’t always trade the same assets, and information that was once predictively useful may lose relevance as a result of long-term shifts in economic and market structures.

In managing our process over time, that means we have to make decisions about how to adapt. We certainly make use of historical analysis to evaluate hypotheses and calibrate our approach, but it’s of foremost importance to identify and understand trends, environmental and otherwise, that will affect commodities markets going forward.

That mindset has put a premium on exploiting alternative data sources to infuse our investment process with highly specialized information relevant to specific markets. In the context of environmental themes, examples would include incorporating information about lower-frequency climate patterns into natural gas forecasts and shorter-term weather fluctuations to forecast agriculture and softs.

In summary, a robust systematic process should incorporate the broadest possible investment universe and the full set of contemporarily relevant information in relation to environmental and other ESG themes.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to CCAT Partnership Capital INC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

CCAT provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. CCAT has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. CCAT has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

CCAT’s quantitative investment process is supported by extensive proprietary computer code. CCAT’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

CCAT Partnership Capital INC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of CCAT Partnership Capital INC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of CCAT Partnership capita

CCAT Partnership Capital INC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

CCAT Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

CCAT Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, CCAT Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

CCAT Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. CCAT Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.